Bombardier's recent stock decline 'absurd' and 'extreme', analysts say

The stock selloff that saw shares of Bombardier Inc. plummet to a 52-week low last week is “absurd” and “extreme”, according to some analysts.

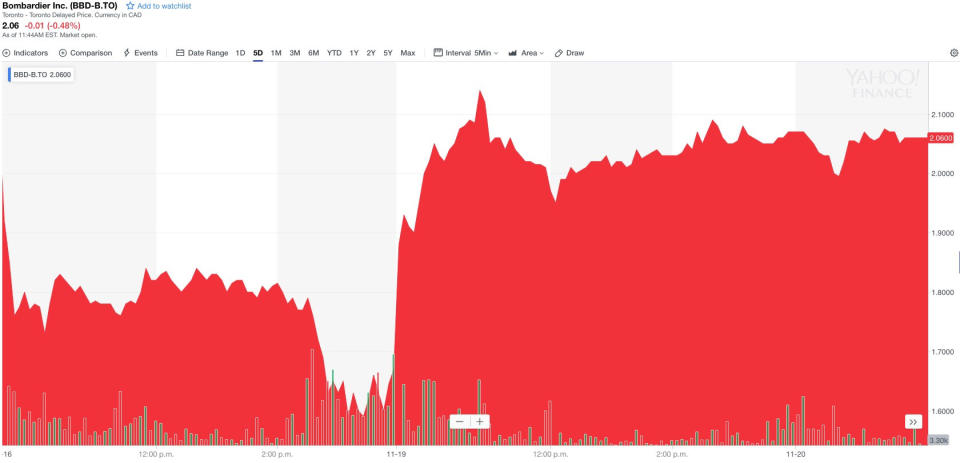

Bombardier’s stock dropped 20 per cent last Friday after the Autorite des Marches Financiers, Quebec’s financial markets regulator, said the day before that it would review transactions related to company’s executive compensation plan. The news came a week after Bombardier reported a $600 million shortfall of free cash flow in its third quarter earnings, a key financial metric watched closely by analysts. The plane and train maker’s stock had fallen 24.5 per cent following the release of quarterly results.

In a note to clients released late Monday, National Bank analyst Cameron Doerksen described the selloff as “absurd”, “unjustified” and “irrational.”

“Bombardier shares are now trading at a level below where the stock was trading in early 2015 prior to the beginning of the company’s turnaround,” Doerksen wrote.

“Since 2015 Bombardier has close to doubled its profitability, its financial position is much improved and the risk profile for the company is dramatically better… Even with the rebound in the share price on Monday, we believe that the magnitude of this sell off in the stock is unjustified.”

Doerksen said the fact that the stock is trading at a level below where it was in 2015 is “irrational” as the balance sheet three years prior was in trouble, with its cash flow performance significantly worse than originally forecast. Even with the recent cash flow miss, Bombardier is expected to end the year with around $3 billion cash on hand, $600 million more than in 2015.

Bombardier has also removed the risk surrounding the development of its aircraft programs, Doerksen wrote. In 2015, the company had yet to complete a test flight program of its CSeries aircraft, and its Global 7500 program was still in the early development phase. Today, the CSeries is being used by multiple airlines and a majority of the financial risk of the program has been taken on by Airbus. The Global 7500 has also been certified.

This is not the “old” Bombardier, Doerksen wrote, “which had a history of falling short of expectations, especially when it came to free cash flow.”

“We view this as unfair, noting that Bombardier is on track to meet or exceed the 2020 targets that were laid out at the company’s investor day in late 2015,” Doerksen said.

“The current management, which were all largely brought on board in 2015, have also made some difficult but necessary decisions to put the company on a path to sustainable financial success.”

Doerksen wasn’t the only analyst that was critical of the selloff.

CIBC World Markets analyst Kevin Chiang said in a note to clients Tuesday that while Bombardier is a higher-risk investment, the selloff was overdone.

“With Bombardier sitting on $9.2 billion of debt and still in the midst of its restructuring plan, the company does require a higher risk premium today than earlier this year,” Chiang wrote.

“However, we consider the recent sell-off as extreme… We expect underlying value within the company to surface as Bombardier approaches in 2020 targets.”

Citigroup analyst Stephen Trent wrote in a note released late Sunday that the regulatory review of the company’s executive stock-sale plan “appears routine” while the selloff last week’s selloff “looked unreasonable.”

Bombardier’s stock was trading at $2.05 on the Toronto Stock Exchange as of 11:15 a.m. ET Tuesday, a decline of nearly 1 per cent.

With files from Bloomberg News.

Download the Yahoo Finance app, available for Apple and Android.