The Ronald O. Perelman Garage Sale: Why is the Revlon Billionaire Unloading Assets?

Billionaires—especially those who leverage and buy out—unload pricey assets all the time. They sell during upturns, downturns, and global pandemics—the timing doesn’t really matter for those who operate in the financial stratosphere.

Only a few months ago, for example, Henry Kravis (of Barbarians at the Gate fame) sold a Colorado mansion he built in 1991 to Mike Bloomberg (of $900-million-failed-presidential-bid fame) for $45 million. No big deal. It barely made the real estate pages.

But recently, one of the country’s most feared dealmakers—Revlon majority stockholder and longtime occupant of the Forbes and Bloomberg billionaire ranking lists—Ronald O. Perelman, has been making news by selling assets. A lot of them. Rapidly.

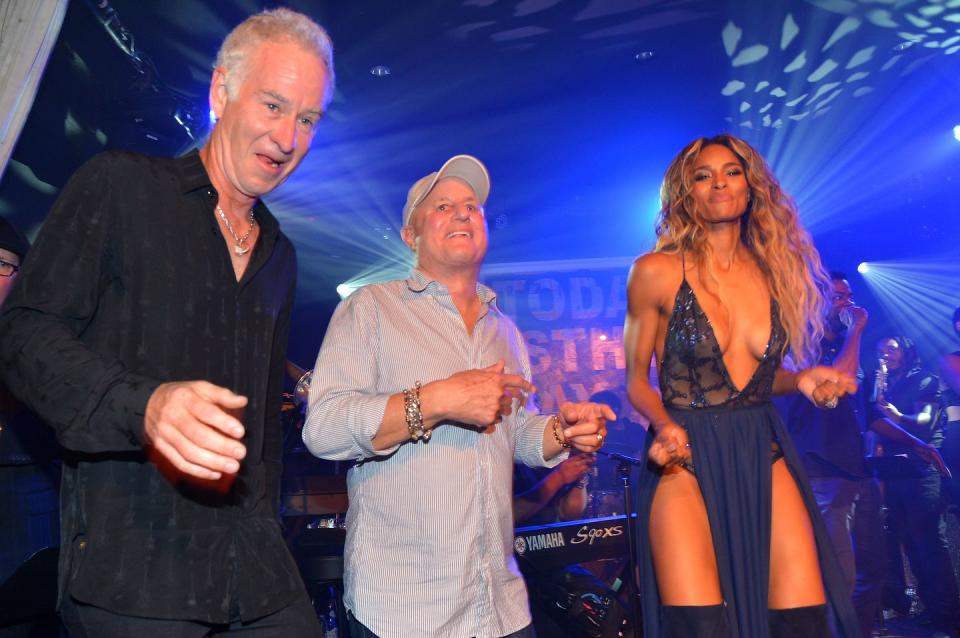

Earlier this month, the New York Post reported Perelman was shopping his 57-acre East Hampton estate, the Creeks, for $180 million in a so-called “whisper sale.” (A spokesperson for Perelman told the paper that the property is not on the market.) The Creeks is where Perelman held an annual, celebrity-packed fundraiser, Apollo in the Hamptons, from 2009 to 2019 to benefit the Harlem theater.

On September 14, MacAndrews & Forbes, an investment company owned by Perelman, announced it would sell its shares of Scientific Games, a maker of casino, interactive, and instant lottery games, for an estimated $1 billion.

On July 28, two paintings from Perelman’s vast art collection, Peinture (Femme au Chapeau Rouge) by Joan Miró and a portrait of Carla Avogadro by Henri Matisse, were sold at auction by Sotheby’s for a combined $37.2 million (the estimate had been $53 million). According to Bloomberg, the pieces were the first among many works owned by Perelman that the auction house will offer.

MacAndrews & Forbes agreed to sell its majority stake in AM General, the maker of Humvee military jeeps, to KPS Capital Partners LP on July 22, 2020, for an undisclosed sum. (The Post estimates $1 billion).

In June, MacAndrews & Forbes completed sales of Merisant and MAFCO, a sweetener and natural licorice company, respectively, that it had announced in December 2019, for $510 million.

Is Perelman running out of money?

Selling off companies and paintings isn't enough to raise Wall Street eyebrows, but Perelman has appeared in the news for other reasons, including in September when the Bloomberg Billionaires Index estimated his net worth had dropped from $19 billion to $4.2 billion in a two-year period.

In August, Revlon announced a revenue decline of 39 percent in second quarter results. In June, MacAndrews & Forbes parted ways with its longtime CFO. And in 2019, Perelman engaged Goldman Sachs to initiate a possible sale of Revlon.

In separate statements to Vanity Fair and Bloomberg, Perelman acknowledged that MacAndrews & Forbes had faced challenges during the pandemic, but said recent transactions were about simplifying his life, spending more time with his family, and strategically repositioning his assets.

Perelman, who is 77 years old, does have a lot of stuff, including an art collection estimated at over 1,000 works, numerous properties, a yacht, and other tangibles. He is also the father of eight children, two of them with Anna Chapman, his fifth wife. And he is one of the world's most active philanthropists.

Air Mail editor Graydon Carter, a longtime friend of Perelman’s, told Bloomberg, “Often when people say this sort of thing, it’s masking something else. In Ronald’s case, it’s true. He has learned to love and appreciate the bourgeois comforts of family and home.”

Made in the shade

As recent reporting by the New York Times on President Trump’s business dealings has shown, it is difficult to determine modern mogul’s exact worth. Access to bankruptcy filings, specifics about loan terms, and tax documents helps but doesn’t guarantee an absolutely clear picture.

No one knows for sure what the longterm effects of our current global financial situation will be (some corporations and individuals are actually thriving), but in general companies and large-scale investors are facing prolonged headwinds and those that wish to pay off loans, or obtain new ones against already leveraged assets, are seeing especially hard times. Similar conditions during the 2008 downturn ruined a number of world's wealthiest investors, including Adolf Merckle and Seán Quinn.

Any tycoon worth her or his salt plays financial opacity to their advantage. And those who borrow large sums to fund corporate acquisitions often go to great length to maintain a reputation of solvency. (The New York Times noted that some insiders had speculated that a possible motive for Donald Trump’s launching a presidential campaign in 2016 was to improve his reputation among investors.) But an air of financial mystery can also backfire, especially when there is a string of noteworthy sales.

In other words, if the financial news doesn’t get better for Perelman, he may have to run for President.

You Might Also Like