Silicon Valley Bank stock just reopened for trading and it's seeing some wild swings after plunging to as low as a penny

After being halted for more than two weeks, shares of Silicon Valley Bank reopened for trading.

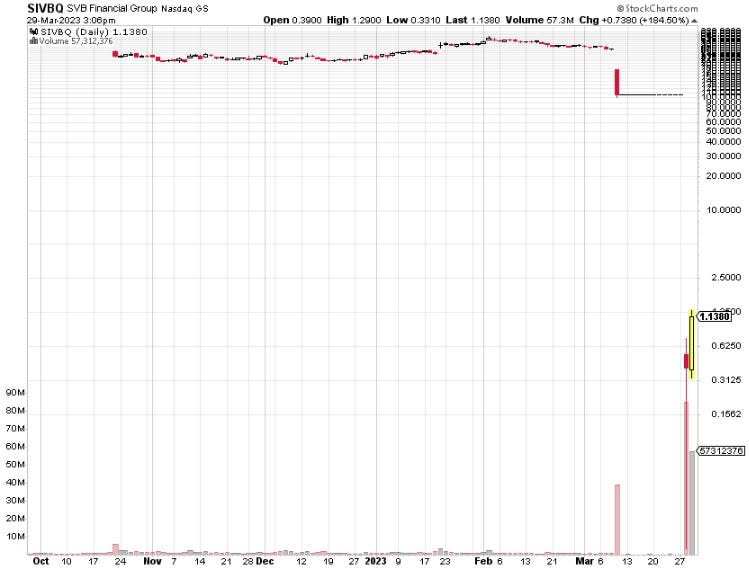

The stock fell to as low as a penny on Tuesday, and has since rallied more than 9,000% to nearly a dollar.

Silicon Valley Bank trades under the ticker symbol "SIVBQ" and is in the process of being acquired.

Silicon Valley Bank stock has reopened for trading after being halted for nearly three weeks, and the stock is swinging wildly.

The collapsed bank's stock was halted for trading on March 9 after it failed to raise $2.1 billion and ease concerns about its deposit base. One day later, the bank failed and was taken over by the FDIC.

The stock was halted at $106.04 per share. On Tuesday, trading reopened at $0.53 a share, representing a decline of 99.5% from its prior price.

Once the stock was reopened, traders flooded the name with wild swings in both directions. On Tuesday, shares of Silicon Valley Bank — which currently trade under the ticker symbol "SIVBQ" — fell to as low as a penny. Since then, they have surged more than 12,000% to a high of $1.21 per share on Wednesday.

It's unclear why traders are piling into the stock on Wednesday aside from speculation to eke out some gains before the stock is ultimately delisted.

The delisting should happen after First Citizens Bank completes its purchase of Silicon Valley Bank. First Citizens will purchase $72 billion worth of assets from the bank for a discounted price of just $16.5 billion. First Citizen's will also take on about $56 billion of deposits from the failed bank.

To be clear, there is no equity value in Silicon Valley Bank despite its stock trading in an extremely volatile range. The former parent company of Silicon Valley Bank, SVB Financial, filed for bankruptcy, essentially wiping out all equity holders and sparking big losses for its bond holders.

But that won't stop traders from speculating in a volatile stock, trying to make a profit.

Read the original article on Business Insider