10 Ways To Build Your Wealth Better, According to Experts

You're ready to get to a better place financially; you just need a little help. Whether you have money and aren't sure what to do with it or need to start earning more, there's plenty of advice to guide your next move.

Top money experts such as Jim Cramer and Tori Dunlap have made careers of helping people make better money choices, so you can feel confident in their guidance. They likely have tips to offer that you've never considered -- and they can be life-changing.

The Future of Finances: Gen Z & How They Relate to Money

Do You Have a Tax Question? Ask a Tax Pro

Read: With a Recession Looming, Make These 3 Retirement Moves To Stay On Track

If you feel like you're alone in needing their advice, you're definitely not. Many people are currently at a place where they could use the help of some the nation's top financial minds.

In fact, 60% of U.S. adults believe the COVID-19 pandemic has been highly disruptive to the way they manage their finances, according to Northwestern Mutual's 2022 Planning & Progress Study. About 48% said they have been able to adapt, but 13% have not.

Ready to get some financial advice that could make a huge difference in your life? Here are 10 tips to better build your wealth, from some of the most recognizable names in finance.

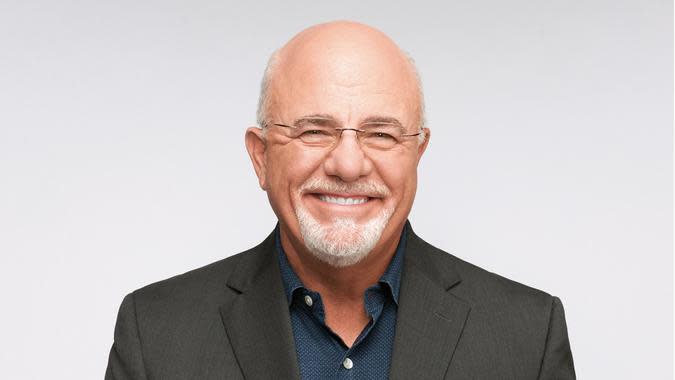

Have a Written Plan for Your Money

It's hard to build wealth if you're spending freely.

"The first thing is to have a written plan for your money -- aka a budget," finance expert Dave Ramsey said. "If you want to build wealth, you have to plan for it. Next, get out of debt, and stay out of debt. Your most powerful wealth-building tool is your income. And when you spend your whole life sending payments to Sallie Mae, banks and credit card companies, you end up with less money to save and invest for your future."

Take Our Poll: Are You In Favor of More Inflation Relief in 2023?

Invest in an Index Fund

If you're thinking of putting some of your money in the stock market, Jim Cramer, head of the CNBC Investing Club and host of the network's "Mad Money," knows exactly where you should start.

"Everyone should own an index fund first," he said, "and, only after you think you have built it up considerably, THEN can you buy individual stocks."

Maximize Your Earning Potential

Perhaps you're earning enough money right now, but you could be earning more. Tonya Rapley, founder of financial education and lifestyle blog My Fab Finance, said it's important to make sure you're doing enough.

Her advice to build better wealth is "maximizing your earning potential and then consistently positioning your money to make more money through active and passive investments."

This multi-step process can help you get to an amazing financial place you never thought you'd reach.

Become an Investor

If you're not currently investing your money, there's no time like the present to start.

"Learn how to become an investor," said Danetha Doe, founder of wealth education company Money & Mimosas. "Being an investor means your money works for you, so you do not always have to work for your money."

Investing your funds can allow you to earn money while doing nothing. If you're looking for a way to build wealth that requires minimal effort, this is it.

Set Actionable Goals

Money moves won't happen unless you make them. Of course, this can seem overwhelming in the beginning.

"Set actionable goals and then invest and be consistent, even if you start with a small amount," said Erin Lowry, author of the "Broke Millennial" book series. "It's much harder to achieve your big financial goals without investing."

Whether you choose to invest your money or not, setting small actionable goals today can help you live a wealthier tomorrow.

Invest Wisely

Are you ready to start investing but don't know where to start? Sam Bankman-Fried, CEO at crypto company FTX, has simple advice.

"Keep enough capital to be comfortable in safe assets, and be aggressive with the rest," he said.

You'll likely want to work with a financial advisor to create a plan that fits your needs. However, this tip can get you started down the right path toward building a strategy that boosts your net worth.

Improve Your Financial Literacy

When comes to building wealth, knowledge is power.

"No matter how much money you currently have, you may build your wealth by improving your financial literacy through researching free, creditable resources online," said Taylor Price, a Gen Z personal finance expert known as @pricelesstay on TikTok.

"According to the Global Financial Literacy Center (2022), people who have received a financial education tend to have a higher level of financial literacy," she said. "In turn, this can lead to people being less likely to face financial difficulties and ultimately build wealth."

Supplement Your Income

Working a little harder for the money can literally pay off.

"You need to find opportunities to supplement your income," said John Liang, personal finance expert with about 2.5 million followers on TikTok and Instagram. "A 10% return is great; however, if that 10% return is on a $100 cost basis, that isn't nearly as impactful as if you had $1,000 or $10,000.

"Of course, that won't happen overnight; but, if you're just waiting for your yearly inflation-adjusted raise or hoping for a 10X on a miracle company, that just won't do it. Find ways to generate additional income to truly accelerate your ability to build wealth."

Invest Your Money

The importance of investing cannot be emphasized enough. But Tori Dunlap, founder of Her First $100K, tries.

"Invest, invest, invest," she said. "You will never be able to retire if you don't invest. You will never be able to pass money down to your children or have true financial independence if you're not investing your money in the stock market.

"Women are primarily kept in the dark about investing and wealth building, and that's on purpose," she said. "It's especially crucial for women to have access to financial education because women are statistically likely to lose $1 million over their lifetime to the investing gap. The stakes are incredibly high, so the more women begin to learn about investing and long-term wealth building, the better."

Commit to Building Wealth

If you think you can improve your financial situation, you'll do exactly that.

"Change your mindset around wealth," said Mandi Woodruff-Santos, co-host of the "Brown Ambition" podcast. "Tell yourself it's possible to build wealth, that you can learn anything, and that you can do it! Once you begin to internalize your ability to build wealth, it makes it easier to take the steps needed to increase your earnings, start investing and learn along the way."

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 10 Ways To Build Your Wealth Better, According to Experts