Beauty Consumer Fatigue Is Hitting, Launchmetrics Study Shows

PARIS — Is consumer fatigue starting to hit the beauty industry?

A new study by data research and insights company Launchmetrics suggests the answer is “yes” in its new study, entitled “S1 ’22: Business of Beauty — Top 700 Performers.”

More from WWD

That takes into account 741 beauty brands, a total of $12.5 billion in media impact value, or MIV, and 3.1 million placements.

“While beauty is considered an affordable luxury in a time of economic uncertainty, there has been an increasing concern over consumer fatigue in the sector,” Launchmetrics wrote in the study. “Overall consumer engagement across social media has decreased year-over-year.”

Launchmetrics said that while Instagram and YouTube continue to be the juggernauts in driving reach, they have registered a decline of MIV on-year. Conversely, TikTok has been generating MIV growth for many beauty brands, through shorter-format videos.

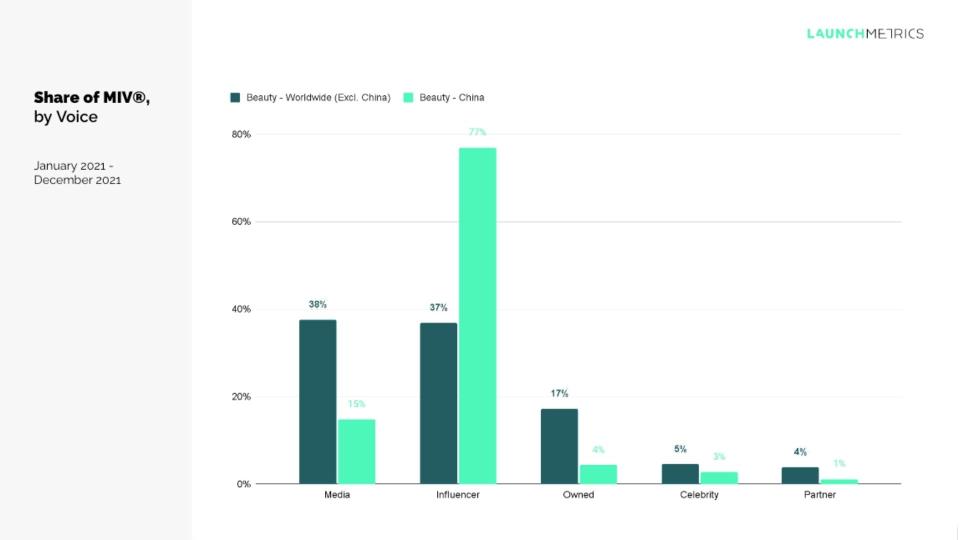

The beauty industry is more reliant on influencers than the fashion industry, especially in China.

“Whereas beauty brands drive a bigger share of MIV via media and owned channels outside of China, influencers account for the majority of MIV for brands in the region,” Launchmetrics said.

For beauty in 2021, media lassoed 38 percent of MIV worldwide excluding China, and 15 percent of MIV in China. Influencers grabbed 37 percent of MIV globally outside China, versus 77 percent in China. The breakdown of owned MIV was 17 percent and 4 percent, respectively.

Despite social media’s ongoing strength as beauty’s top channel for driving MIV, Launchmetrics noted overall consumer fatigue across the board.

“While Instagram continues to be the number-one highest MIV-generating platform [with $2.8 billion MIV], its average MIV per placement is much lower compared to those of newer platforms, such as Douyin, Weibo and TikTok,” wrote Launchmetrics. “Shorter-format video platforms — Douyin, TikTok — not only over index in terms of efficiency but also drive stronger growth in MIV year-over-year.”

TikTok notched up the most growth, increasing beauty brands’ MIV by 176 percent in the period.

“The era of in-depth tutorials by beauty vloggers has passed,” said Launchmetrics. Longer-format videos, generally of more than 10 minutes, perform best on YouTube, and lifestyle videos made up many of the top videos generating the highest MIV. That included Thugesh’s nine-minute-and-44-second video that rung up $816,000 in MIV and Architectural Digest’s 15-minute-and-55-second video that garnered $706,000 in MIV.

On the flip side, the best-performing videos on TikTok are generally shorter than one minute and feature celebrities, influencers or entertainment content.

“Three out of the top five TikTok videos with the highest MIV were published on celebrity handles,” wrote Launchmetrics. “And four out of five featured a celebrity within the content itself.”

A 20-second video by Kylie Jenner rang up $2.4 million in MIV, while Twenty4Tim’s 58-second spot grabbed $2.2 million in MIV.

Total MIV made by YouTube decreased 21 percent in the July 2021 to June 2022 period versus the July 2020 to June 2021 period.

Whereas star influencers resonate the best on China’s social platforms, Launchmetrics said that key to success on western platforms is diversified Key Opinion Leaders.

In the first half of 2022, influencers generated more than $5.6 billion in MIV, making them the most effective voice in the beauty industry.

“However, there’s no one-size-fits-all solution when it comes to influencers,” wrote Launchmetrics. “There has also been a shift in consumer perception on influencers, especially when it comes to celebrities.”

Micro-, mid-tier, mega and star influencers are popular to different degrees, according to the social media platform. Star influencers accrue the most share of MIV on Chinese social-media platforms such as Weibo and WeChat, compared to mid-tier and mega influencers playing a much more important role driving MIV on Instagram and Facebook.

Despite the large number of celebrity beauty brands launched over the past two years, Launchmetrics found that consumer skepticism has never been at a higher level. It said 67 percent of consumers have a “low” trust level when it comes to celebrity influencers, especially vis-à-vis health and beauty products.

Consumer engagement reflects this, with celebrity beauty brands, on average, seeing a decline in their MIV stats on-year.

Bucking that trend, however, is star influencer beauty brand Kylie Cosmetics. It took 18th place in Launchmetrics’ report, generating more than $121 million in MIV, which represented 39 percent on-year growth.

The top 10 brands in the first half of 2022 according to MIV were Dior, with $388 million, thanks to Jisoo Kim; L’Oréal Paris, the only mass-market brand, with $360 million; Lancôme, with $337 million; MAC Cosmetics, with $274 million; Estée Lauder, with $260 million; Chanel, with $243 million; Nars, with $199 million; Charlotte Tilbury, with $194 million; Fenty Beauty, with $183 million, and YSL Beauté, with $174 million.

The top five beauty brands with the most on-year MIV gains were: Viktor & Rolf, up 225 percent to $7.8 million; Escada, with a 114 rise to $929,000; Mont Blanc, with an increase of 112 percent to $6.7 million; AmorePacific, with 106 percent growth to $48 million, and Coach, posting an 88 percent rise to $3.5 million.