Why Investors Shouldn't Be Surprised By Vertiv Holdings Co's (NYSE:VRT) 49% Share Price Surge

Vertiv Holdings Co (NYSE:VRT) shares have had a really impressive month, gaining 49% after a shaky period beforehand. But not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

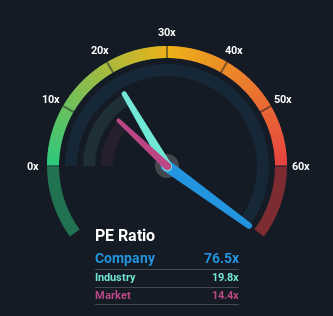

After such a large jump in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 14x, you may consider Vertiv Holdings Co as a stock to avoid entirely with its 76.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Vertiv Holdings Co hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Vertiv Holdings Co

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vertiv Holdings Co.

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Vertiv Holdings Co's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 52%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 152% over the next year. With the market only predicted to deliver 8.2%, the company is positioned for a stronger earnings result.

With this information, we can see why Vertiv Holdings Co is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Vertiv Holdings Co's P/E

Vertiv Holdings Co's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Vertiv Holdings Co's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Vertiv Holdings Co (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

If you're unsure about the strength of Vertiv Holdings Co's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here