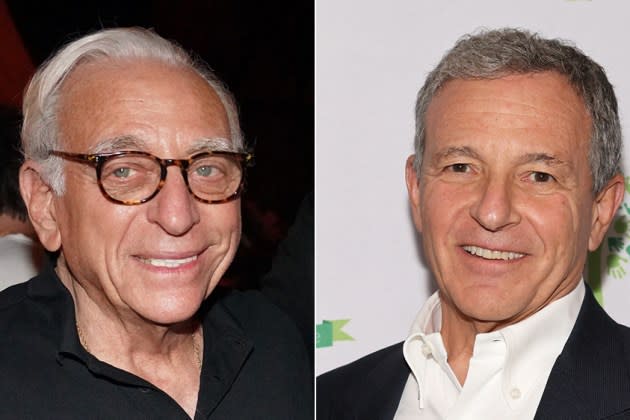

Nelson Peltz Claims He Backs Disney CEO Bob Iger, but His Investment Firm Withheld Votes for Iger’s Election to the Board

Nelson Peltz claims Disney’s board, not CEO Bob Iger, is the problem. But his investment firm, Trian Group, withheld its votes for Iger’s reelection to the Disney board.

With just over a week before Disney’s annual shareholder meeting on April 3, Peltz’s Trian — which has been aggressively campaigning to get two seats on the Mouse House’s board — issued a new statement Monday saying the battle is not about any dispute with Iger but rather about forcing change on the board’s composition to boost the company’s financial returns.

More from Variety

“In this election contest, Disney has emphasized that Mr. Iger is admired and respected (including, for example, by service providers and advisors), which we do not doubt,” the hedge fund said in the statement. “Trian supports Mr. Iger as a candidate for the board and as CEO. That Disney spends so much time and ink defending Mr. Iger — while saying almost nothing about the two director candidates whose reelection Trian is challenging — is both troubling and telling. This campaign is not about Mr. Iger, nor is it a referendum on his leadership. And in all events, Disney is, and must be, more than just one person, especially one whose contract expires in less than two short years.”

While the statement said that “Trian supports Mr. Iger as a candidate for the board and as CEO,” the investment firm has withheld its votes for Iger’s board candidacy. Asked for clarification on the matter, a rep for Trian declined to provide an official comment.

Trian’s statement asserted that the Disney board “botched its most important job – CEO succession – by installing Bob Chapek in that role seemingly without appropriate vetting or oversight. The board then renewed Mr. Chapek’s contract just months before firing him for poor performance. Ultimately, the board had to call Bob Iger out of retirement to fill the void.”

Disney has called Trian’s proxy fight “disruptive and destructive” and said Peltz’s “quest also seems more about vanity than a belief in Disney.” The media company has characterized Trian’s campaign as fueled by a “longstanding personal agenda” harbored by ex-Marvel Entertainment chairman Ike Perlmutter against Iger. Trian controls roughly $3.5 billion worth of Disney stock, 79% of which is owned by Perlmutter. Last year, Disney terminated Perlmutter’s employment.

Investors are voting on rival board candidate slates — Disney’s own 12-member lineup; two nominated by Peltz’s Trian Partners (Peltz himself and ex-Disney CFO Jay Rasulo); or three from another investment firm that has entered the fray, Blackwells Capital. In the weeks leading up to the April 3 meeting, Disney and Iger have received the backing of George Lucas (Disney’s largest individual shareholder), former Disney CEO Michael Eisner, large shareholder Laurene Powell Jobs, the grandchildren of Walt Disney and his brother Roy O. Disney, and proxy-advisory firm Glass Lewis.

Disney had a setback in the fight with Peltz last week when influential advisory firm Institutional Shareholder Services (ISS) recommended shareholders elect Peltz to the Disney board (but not Rasulo). In its report, ISS cited Disney’s “failed” CEO succession planning and said Peltz “could be additive to the succession process, providing assurance to other investors that the board is properly engaged this time around.” (Disney chairman Mark Parker responded that “we strongly believe that ISS reached the wrong conclusion.”)

Trian called Disney “the most advantaged consumer entertainment company in the world” but alleged it “has woefully underperformed its potential and its peers, costing shareholders more than $200 billion in value.” Trian has urged Disney shareholders to vote for Peltz and Rasulo and withhold support from two incumbent Disney directors, Maria Elena Lagomasino and Michael Froman. ISS also recommended Disney shareholders withhold votes for Lagomasino, who is CEO and managing partner of WE Family Offices.

“We believe that reelecting the existing board will have the predictable effect of leading to more of the same: questionable strategic and capital allocation decisions, poor executive compensation alignment and suboptimal succession planning,” Trian’s March 25 statement said.

Disney has stated it “believes all 12 of its nominees are best qualified to create sustainable shareholder value. The Disney board of directors is comprised of engaged, diverse and dynamic leaders whose skills, perspectives and insights are essential in driving profitable growth and delivering on Disney’s strategic priorities as the company navigates ongoing, industry-wide challenges.”

Disney has told shareholders Peltz “brings no media experience and has presented no strategic ideas for Disney,” while the perspective of Rasulo — formerly CFO of Disney — “is stale given he left Disney in 2015 and has not held any executive positions in the industry since.”

In its statement, Trian reiterated that it “believes Disney’s problems lay at the feet of the board, which lacks focus, alignment and accountability. Although the board members are accomplished professionals, they are extraordinarily busy, have invested almost none of their own money in Disney stock and have failed to heed investor input. The result has been questionable strategic and capital allocation decisions, including the investment of $200 billion of capital without any discernible return, the demonstrable lack of alignment between executive compensation and shareholder value creation and financial results in the most recent year that pale in comparison to the results five years ago.”

Trian’s full letter is available at this link.

Disney’s annual meeting of shareholders will be held on Wednesday, April 3, at 10 a.m. PT by virtual meeting at virtualshareholdermeeting.com/DIS2024 and will be made available via webcast at disney.com/investors.

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.