Notarize launches Proof to ensure safe online transactions

Notarize, the world’s largest online notary network, is launching Proof, a new company and platform for digital identity verifications. Beginning in August, Notarize’s business tools will be rebranded to Proof, and it is also changing its company name to Proof. Notarize will continue serving its online notary network, which is used by companies like Adobe and FedEx, and the two brands and platforms will exist side-by-side, said founder Patrick Kinsel.

Created in response to the rise in online transactions, Proof is an enterprise-grade platform, designed to serve large banks and real estate companies. It will continue to have all the main components of Notarize’s online notary service, which has been used by millions of users to process transactions like real estate e-closings, vehicle bills of sales and documents like affidavits of identity and power of attorneys. What’s new in Proof is an identity-assured transaction management platform meant to address gaps in online identity verification.

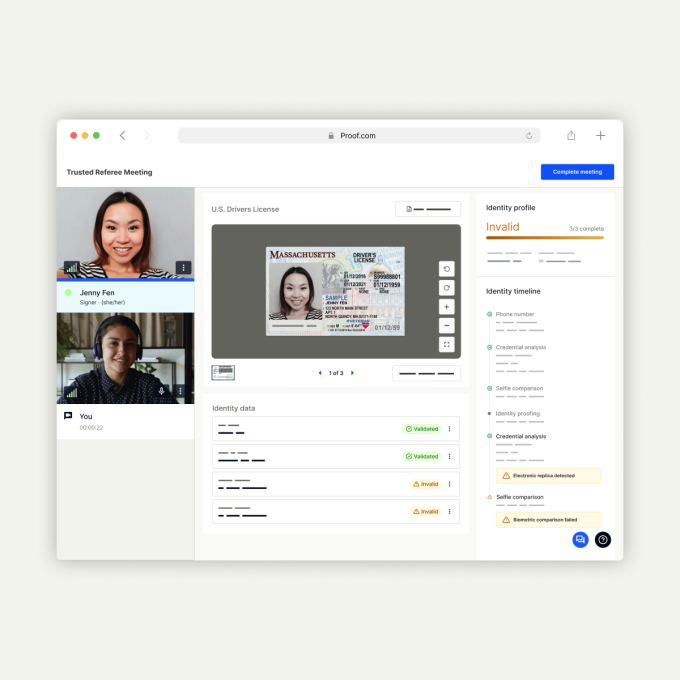

Some examples of the services it offers include verification identity using biometric tech (for example, scanning selfies to make sure they match ID photos), 24/7 human verification of identity and signature verification to ensure that the person signing is who they actually say they are. Proof also looks out for fraud risk in each transaction, the same way credit cards are monitored. For example, if a signature looks like it might be forged, Proof flags it for review.

Proof's ID verification feature. Image Credits: Notarize

Proof monitors fraud signals with a risk score based on data like location, device fingerprint, carrier network and prior rejections. All of its transactions are protected with encryption and are NIST IAL-2 compliant, and will be AATL compliant later this year. NIST is the National Institute for Science and Technology and it publishes standards used by government agencies and industries. For example, the National Highway Transportation Administration requires an IAL2 standard for electronic auto sales, which means consumers must provide a combination of identity evidence.

AATL, meanwhile, is the Adobe Approved Trust List, which dictates how PDF documents are cryptographically signed. Kinsel said that by meeting this, Proof will the first platform whose documents are tied to a valid legal identity in accordance with Adobe’s standards. “Our vision is that everything should be cryptographically signed with identity and Acrobat is the trusted reader to instantly confirm the authenticity of every action online,” he added.

If a signer fails to pass Proof’s digital safeguard for automated verification, they will be matched with one of Notarize’s more than 4,000 notaries to complete the document and transaction.

Kinsel told TechCrunch that Proof’s ability to confirm identity and flag risk leverages Notarize’s innovation in identity verification, including its ability to verify photo IDs like driver licenses and passports, present identity challenge questions, perform biometric selfie verification and confirm data attributes from information like consumer addresses and phone numbers. “When we swipe a credit card we know it’s being protected with active fraud monitoring and Proof will deliver the same for the agreements we enter,” he said.

Some examples of how Proof can be used include securing the seller in a real estate transaction, who don’t require notarization but are still at risk with only a basic e-signature, Kinsel said. Proof is also being used by the retirement industry to protect large withdrawals from fraud, and in the auto industry to notarize forms in some states and meet IAL2 standards elsewhere.

Since its launch in 2015, Notarize has been adopted by 2,200 companies, including First American, iPostal, Guaranteed Rate, Salesforce, SimpleNexus, SnapDocs, USAA and Zillow. Notarize says that almost 80% of those transactions were identity affirmations, as e-signatures are becoming increasing targets for fraud as online agreements become more common. Proof was created to expand Notarize’s services beyond notarization and create verifications of consumer identity with each transaction that it says are impossible to forge.

Notarize raised a $130 million Series D in 2021, at a valuation of more than $760 million, which it used to build Proof. Its investors include Camber Creek, Polaris Ventures and Realogy.