PacBio (PACB) Tops on Q1 Earnings, Raises FY23 Revenue View

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, delivered an adjusted loss per share of 31 cents in first-quarter 2023, narrower than the year-ago loss of 37 cents. The figure was also narrower than the Zacks Consensus Estimate of a loss of 33 cents.

Our projection of adjusted loss per share was 35 cents.

The company’s GAAP loss per share was 36 cents in the quarter, narrower than the year-ago loss of 37 cents.

Revenues in Detail

PacBio registered revenues of $38.9 million in the first quarter, up 17.3% year over year. The figure surpassed the Zacks Consensus Estimate by 10.6%.

The first-quarter revenues compared favorably with our estimate of $34.7 million.

The top line benefited from the year-over-year uptick in product revenues.

Geographical Analysis

PacBio’s revenues from the Americas were $19.1 million, roughly flat year over year. This figure outpaced our first-quarter projection of $18.6 million.

In the Asia-Pacific region, PacBio recorded revenues of $12 million, reflecting a 43% uptick year over year. Revenues from China grew 40% year over year, while Japan also showed strength on the back of continued growth in consumables.

This figure compares to our first-quarter projection of $9.9 million.

Europe, the Middle East and Africa (EMEA) region registered revenues of $7.9 million, which grew 38% year over year. The region witnessed a 5% headwind from currency fluctuations in the reported quarter.

This figure compares to our first-quarter projection of $6.2 million.

Segmental Analysis

Product revenues amounted to $34.7 million, up 22.7% from the prior-year quarter. The figure outperformed our estimate of $29.9 million.

PacBio shipped 38 sequencing systems in the first quarter, including 32 Revio systems and 6 Sequel IIe systems.

Instrument revenues were $20.7 million, up 32.7% year over year. This primarily resulted from the launch of Revio in the first quarter, which was sold at a higher average selling price than the previous Sequel II and Sequel IIe platform.

Our model estimated $12.4 million for this metric.

Consumables revenues for the first quarter of 2023 were $14 million, up 10.2% from the prior-year quarter. Our projection was $17.4 million.

Service and other revenues totaled $4.2 million, down 13.9% year over year. This figure lagged our projection of $4.8 million.

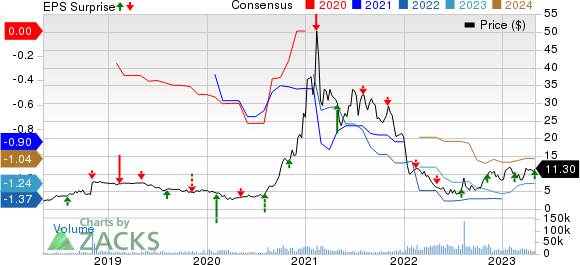

Pacific Biosciences of California, Inc. Price, Consensus and EPS Surprise

Pacific Biosciences of California, Inc. price-consensus-eps-surprise-chart | Pacific Biosciences of California, Inc. Quote

Margin Trend

In the quarter under review, PacBio’s adjusted gross profit fell 30.6% to $9.9 million. Adjusted gross margin contracted a huge 1766 basis points to 25.6%.

We had projected a 35.5% of adjusted gross margin for the first quarter.

Sales, general and administrative expenses inched up 0.03% to $39.8 million. Research and development expenses decreased 7.6% year over year to $48.9 million. Adjusted total operating expenses of $88.8 million declined 4.3% year over year.

Adjusted total operating loss were $78.8 million in the reported quarter compared with the prior-year quarter’s adjusted total operating loss of $78.4 million.

Financial Position

PacBio exited first-quarter 2023 with cash, cash equivalents and investments (excluding short-term and long-term restricted cash) of $874.9 million compared with $772.3 million at the end of 2022.

Guidance

PacBio has raised its revenue outlook for 2023.

The company now expects to achieve revenues in the range of $170-$185 million (indicating growth of 33-44% from 2022 numbers), up from the earlier guided range of $165-$180 million (implying growth of 29-40% from 2022 figures). The Zacks Consensus Estimate is pegged at $172.9 million.

Our Take

PacBio exited the first quarter of 2023 with better-than-expected results. PACB saw a robust increase in its overall top line, including strong revenues from Instrument and Consumables. Solid performances in the Asia-Pacific and EMEA regions were also encouraging.

Continued strong prospects in the Revio and Onso systems, with customers placing orders for these, looked promising for the stock. The newly launched Paraphrase tool and Nanobind DNA Extraction kits boded well.

PacBio also released new workflows in collaboration with Corteva Agriscience that enabled the sequencing of thousands of plants and microbial genome samples annually. This was an added positive.

Yet, dismal bottom-line results were disappointing. The year-over-year fall in Service and other revenues was concerning. The continued adjusted loss per share incurred by the company is also worrying.

The contraction of adjusted gross margin added to the woes. The year-over-year operating loss was another area of concern.

Zacks Rank and Stocks to Consider

PacBio currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Edwards Lifesciences Corporation EW, Intuitive Surgical, Inc. ISRG and Merit Medical Systems, Inc. MMSI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Edwards Lifesciences reported first-quarter 2023 adjusted earnings per share (EPS) of 62 cents, beating the Zacks Consensus Estimate by 1.6%. Revenues of $1.46 billion outpaced the consensus mark by 4.7%.

Edwards Lifesciences has a long-term estimated growth rate of 6.9%. EW’s earnings surpassed estimates in two of the trailing four quarters, missed once and broke even in the other, the average being 1.2%.

Intuitive Surgical reported first-quarter 2023 adjusted EPS of $1.23, which beat the Zacks Consensus Estimate by 3.4%. Revenues of $1.70 billion outpaced the consensus mark by 6.9%.

Intuitive Surgical has a long-term estimated growth rate of 13%. ISRG’s earnings surpassed estimates in two of the trailing four quarters and missed twice, the average being 1.9%.

Merit Medical reported first-quarter 2023 adjusted EPS of 64 cents, beating the Zacks Consensus Estimate by 16.4%. Revenues of $297.6 million surpassed the Zacks Consensus Estimate by 5.9%.

Merit Medical has a long-term estimated growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report