If You Had Bought MDJM (NASDAQ:MDJH) Stock A Year Ago, You Could Pocket A 73% Gain Today

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. To wit, the MDJM Ltd. (NASDAQ:MDJH) share price is 73% higher than it was a year ago, much better than the market return of around 54% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for MDJM

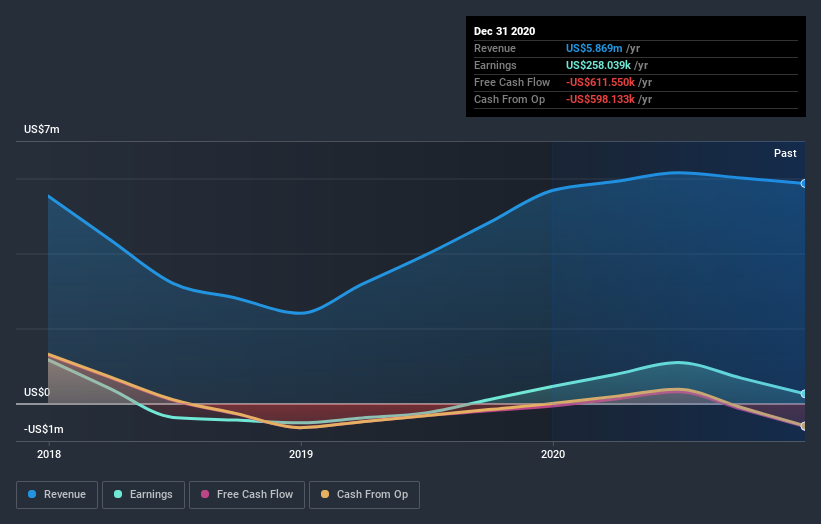

While MDJM made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

MDJM grew its revenue by 3.3% last year. That's not a very high growth rate considering it doesn't make profits. In keeping with the revenue growth, the share price gained 73% in that time. While not a huge gain tht seems pretty reasonable. It could be worth keeping an eye on this one, especially if growth accelerates.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on MDJM's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

MDJM boasts a total shareholder return of 73% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 18% in that time. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - MDJM has 3 warning signs (and 1 which can't be ignored) we think you should know about.

We will like MDJM better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.