A 42-Year-Old Woman Was Quoted A "Ridiculous" Monthly Payment For Her Parent's Long-Term Care. Now Others Are Sharing Their Own Harrowing Eldercare Experiences.

Taking care of and being responsible for an aging parent can definitely be difficult, both mentally and physically, so needing assistance isn't uncommon. Of course, putting a parent in an eldercare facility is an option for those who are unable to properly tend to their parent's needs, but how financially accessible is it in the United States?

In this TikTok with over 500,000 views, many people were left nearly speechless when 42-year-old Tiffany Stuart revealed the quote she received after inquiring about the cost of an eldercare facility. Tiffany, who resides in New York City and called regarding one of her parents, said the monthly cost would be $8,000.

@wellwithtiffany / Via tiktok.com

In the video, Tiffany explains, "I called an eldercare facility to find out pricing for assisted living for potentially one of my parents, and they said $8,000 a month — at least $8,000 a month."

At the end of the TikTok, Tiffany asks a resounding question: "Who's gonna pay for that?"

Over 4,000 TikTok users commented on the video, with many sharing the same shock and sentiment. One user said, "Our system is broken," while another expressed, "Assisted living is only for the rich. It's crazy not ok!"

One of the top comments in the video is from a TikTok user who said, "We tell everyone to save for college, but we don't tell them to save for assisted living." Tiffany then praised the comment, saying, "This comment! The entire conversation needs to be had."

For further insight, we reached out to Tiffany and asked her to detail her experience with seeking out eldercare, along with the challenges that led to it.

Tiffany explained to BuzzFeed that one of her parents has lost mobility over the years. Because of that, it sometimes requires two or three people to help her parent complete tasks like grooming because of the need to lift her parent. Because of the personal physical limitations of in-home aides, they were unable to provide support. "My family has been providing care at home, with my younger brother handling the lion’s share of the daily physical tasks," Tiffany said. "At one point, we received physical therapy at home, but the time of the sessions provided in home were a fraction of in-facility sessions."

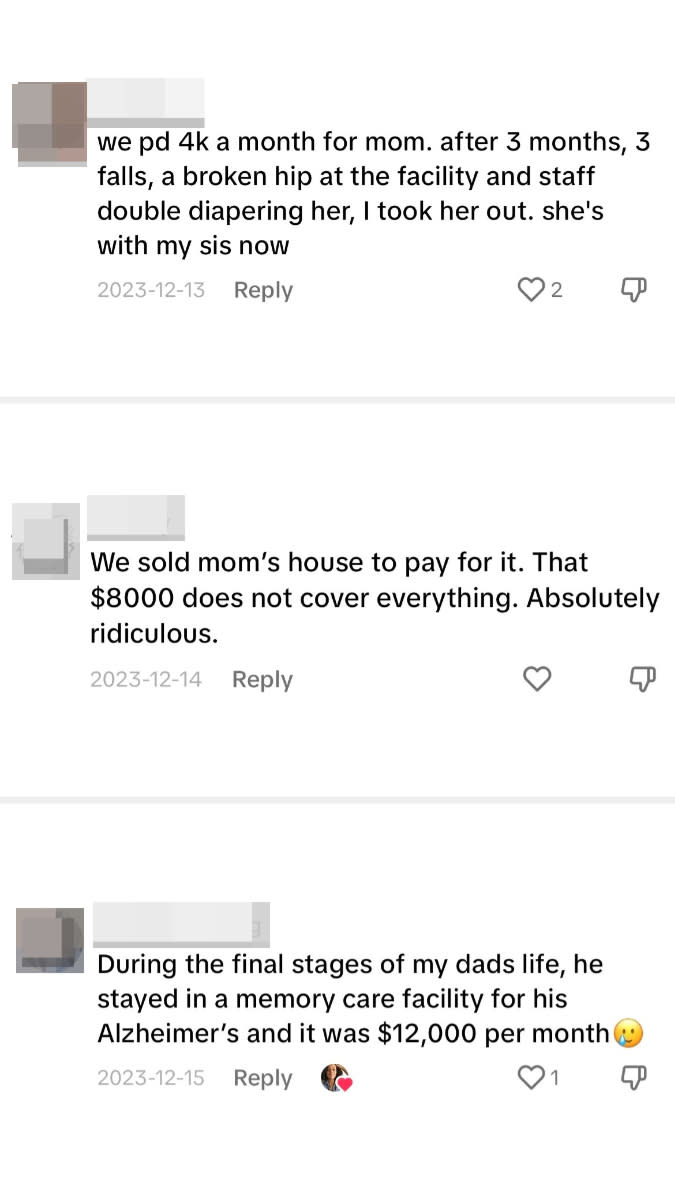

After connecting with eldercare and assisted living providers, Tiffany was told that because of her parent's high medical needs, the cost of care per month would start at $8,000 and could reach $12,000. "This would include meals, care, and living facilities," Tiffany explained. "However, if more skilled services are needed, there would be additional costs."

People in the comments shared their own experiences with their parents and eldercare, with many citing similar circumstances. One user wrote, "During the final stages of my dads life, he stayed in a memory care facility for his Alzheimer's and it was $12,000 per month."

Another user added, "My MIL pays 11,000 a month. They will take all her money and then flip her to government pay. The care is subpar. She'll be broke by next year."

Though many have been, or are, in the same boat as Tiffany, people have also taken to the comments to give advice on how to plan and what to expect if you find yourself seeking eldercare. The most common advice from users, including one commenter who claims to be an administrator for an assisted living community, is to research long-term care insurance. These plans, in theory, assist with and cover long-term services, including eldercare.

It's important to note, however, that long-term insurance policies vary, and costs and coverage are based on certain factors — so one user stresses the importance of thoroughly reading what a prospective long-term insurance plan really entails: "CAREFULLY read a long term care insurance policy-often times it only pays a certain amount per day & it doesn't fully cover the price tag!"

Other commenters suggested having Medicaid pay for the services, and further advised people to have their parents begin transferring or selling their assets at least five years beforehand to qualify. "Medicaid trust varies state by state," one user said. "Look back period vary as well. Be sure to FUND the trust w/the assets to be protected. Do it early!"

To get a more in-depth understanding of what such terms mean and what they call for, BuzzFeed connected with Priya Malani, the founder and CEO of Stash Wealth, a financial planning firm for young professionals. Priya confirms: "Long-term care is just as it sounds — it’s care for the long run. And it is most often utilized for the older population. Outside of paying out of pocket, there are two ways to help afford this major cost: long-term care insurance and Medicaid."

Priya explains that long-term care insurance (LTC) is similar to auto insurance, health insurance, or any other insurance you might be borderline familiar with: It's something you pay for hoping that you'll never have to use it, but you're grateful to have it if you do need it. "LTC insurance was created to help take care of you when you’re older and may not be able to take care of yourself," Priya says. "Think nursing home, memory care facility, in-home care."

However, LTC is something older people may not need to take on if they're lucky enough to have kids who are willing and able (or feel culturally obligated) to take care of them. But as Priya cautions, if you end up needing more help than anticipated, having LTC can serve as a safety net to help pay the bills.

Another option that is available is Medicaid, which Priya describes as a "government program designed to help people who can't afford to pay for medical expenses as they get older." Qualifying for Medicaid is based on your income and assets, and the requirements vary with each state. Since the program was created to assist those with low incomes, if you apply and the state decides you have "too much," you won't qualify.

The qualification process includes a look-back period, in which Medicaid reviews the applicant's recent financial history in an effort to keep people from "hacking the system." In most states, Medicaid will look back as far as five years into an applicant's financial history. Priya tells BuzzFeed, "Without a look-back period in place, you could, hypothetically, transfer all your money to your kids right before you apply so that your financial profile looks more bleak than it actually is, thereby increasing your chances of qualification."

Even if one does qualify for Medicaid, Priya says, it's difficult to say exactly what Medicaid will and won't cover. Sometimes Medicaid will cover nursing home expenses and hospital bills, but it varies. "It’s why there’s so much frustration around how to care for the older generation — it’s like learning another language," Priya explains. "Not to mention, around 70% of people over 65 will require some form of professional care for around three years."

Discussing how you want to be taken care of once you reach a certain point in your life may not be the most fun, but it is necessary. As Priya points out, the worst position to be in is to start thinking about your options when it's too late. She notes that many of her clients in their 30s have aging parents or other relatives in this exact position — who waited too long to start planning.

"With the costs being as high as they are, our clients are setting goals to support the care of their aging relatives," Priya shares. "They do this by systematically setting aside a specific amount of each paycheck, knowing the sooner they start saving and investing, the harder their money can work for them towards this goal."

As for Tiffany, she believes the conversation surrounding eldercare should be broadcast on a bigger platform and should be talked about more. Tiffany told BuzzFeed that although the person who needs care has a great responsibility to create a plan, information should be more accessible and transparent. "There should be more opportunities where this education of prioritizing eldercare planning could come up," she said.

Though it is necessary to think about such long-term plans, Tiffany speaks about the hesitation that some may have when it comes to discussing eldercare. "Much of the delay or general fear in making these plans (at least in some communities and families) come from a fear of death or major sickness," she explains. "As if speaking of it — even to plan — manifests the worst."

If you, like Tiffany, find yourself in a position where you have to start seeking out eldercare options for a loved one or for yourself, Priya recommends speaking with a financial planner so that they can help you understand your options, set goals, and create a plan to meet those goals.

"Make sure the financial planner you’re working with is a fiduciary (meaning they won’t try to sell you things they make commissions on) and is one who has experience with what you’re looking for," Priya advises. "If you’re a young professional looking to set yourself up in the future so your family doesn’t have to worry about you, speak with someone who works with young professionals. If you’re closer to retirement and looking for yourself, speak with someone who works primarily with preretirees."

As shown by Tiffany's experience and the experiences of others, the cost of eldercare facilities can be challenging and difficult to navigate. As she puts it: "As the medical needs increased, we ended up needing more support. And the cost of that support, whether in home or in a facility, is very high. Hopefully this will change in the future."

Have you been through a similar experience with eldercare, either for yourself or with your parents? If you'd like to share your stories or advice, feel free to comment below, or you can submit anonymously using this Google form.

For more content, follow Tiffany on TikTok.