Victoria's Secret (VSCO) Q2 Earnings Lag Estimates, Stock Down

Victoria's Secret & Co. VSCO reported dismal second-quarter fiscal 2023 results, with earnings and revenues missing the Zacks Consensus Estimate. Also, the top and the bottom line declined on a year-over-year basis. The downside was caused by a challenging macro environment, exerting pressure on the customer base and intimates categories. Following the results, shares of the company dropped 2.7% during the after-hours trading session.

The company remains optimistic on account of August sales trends. Also, it emphasizes a new multi-tender loyalty program, a reimagined merchandise strategy (for the PINK brand), new technology and the launch of Victoria’s Secret ICON bra to drive growth in the upcoming periods.

Earnings & Revenues Details

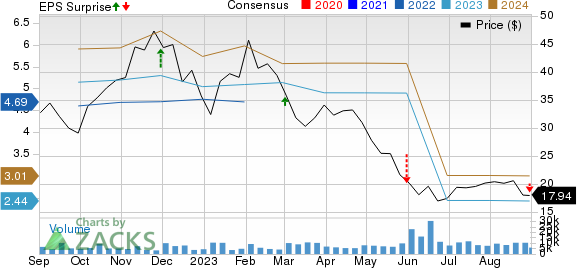

During the fiscal second quarter, the company reported adjusted earnings per share (EPS) of 24 cents, missing the Zacks Consensus Estimate of 27 cents. In the prior-year quarter, VSCO reported an EPS of $1.09.

Victoria's Secret & Co. Price, Consensus and EPS Surprise

Victoria's Secret & Co. price-consensus-eps-surprise-chart | Victoria's Secret & Co. Quote

Quarterly revenues of $1,426.9 million missed the Zacks Consensus Estimate of $1,430 million by 0.3%. The top line declined 6.2% on a year-over-year basis. The downside was primarily driven by a challenging stores and digital intimates market in North America.

During the quarter, total comparable sales (including Stores and Direct) declined 11% year over year compared with an 8% fall reported in the prior-year period.

Operating Highlights

During the fiscal second quarter, General, Administrative and Store Operating expenses came in at $460.5 million compared with $437.7 million reported in the prior-year quarter.

Gross profit during the quarter came in at $486.6 million compared with $535.3 million reported in the prior-year quarter.

Adjusted operating income in the fiscal second quarter came in at $48.7 million compared with $126.9 million reported in the prior-year quarter.

Fiscal 2023 Outlook

For the third quarter of fiscal 2023, the company expects net sales to decline in the low- to mid-single-digit range from the prior-year quarter’s level. During the quarter, adjusted operating loss is anticipated in the range of $45 million to $75 million. During the fiscal third quarter, the company expects adjusted EPS to be between 70 cents to $1.

For fiscal 2023, the company expects net sales to decline in the low-single-digit range on a year-over-year basis. The company expects 2023 adjusted operating income (as a percentage of sales) to be in the range of 5-6%.

Zacks Rank & Key Picks

Victoria's Secret currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Zacks Consumer Discretionary sector are:

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.5% on average. Shares of RCL have gained 141.7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates a rise of 54.5% and 180.3%, respectively, from the year-ago period’s levels.

Trip.com Group Limited TCOM flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 147.9% on average. Shares of TCOM have increased 54.9% in the past year.

The Zacks Consensus Estimate for TCOM’s 2023 sales and EPS indicates a rise of 104.9% and 537.9%, respectively, from the year-ago period’s levels.

Skechers U.S.A., Inc. SKX sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 39.1% on average. Shares of SKX have increased 33.5% in the past year.

The Zacks Consensus Estimate for SKX’s 2023 sales and EPS indicates a rise of 8.7% and 42%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Victoria's Secret & Co. (VSCO) : Free Stock Analysis Report