FTSE 100 Live: Gilt yields approach mini-Budget level; City sees 5.5% interest rates; FTSE closes down 0.7%

Germany’s slide into recession added to pressure on European markets today as the FTSE 100 index endured another session in the red.

A mixed reception to corporate results from Johnson Matthey, Tate & Tyle and United Utilities added to the uncertain mood after Wednesday’s hammering for London stocks due to concerns over a potential US debt default.

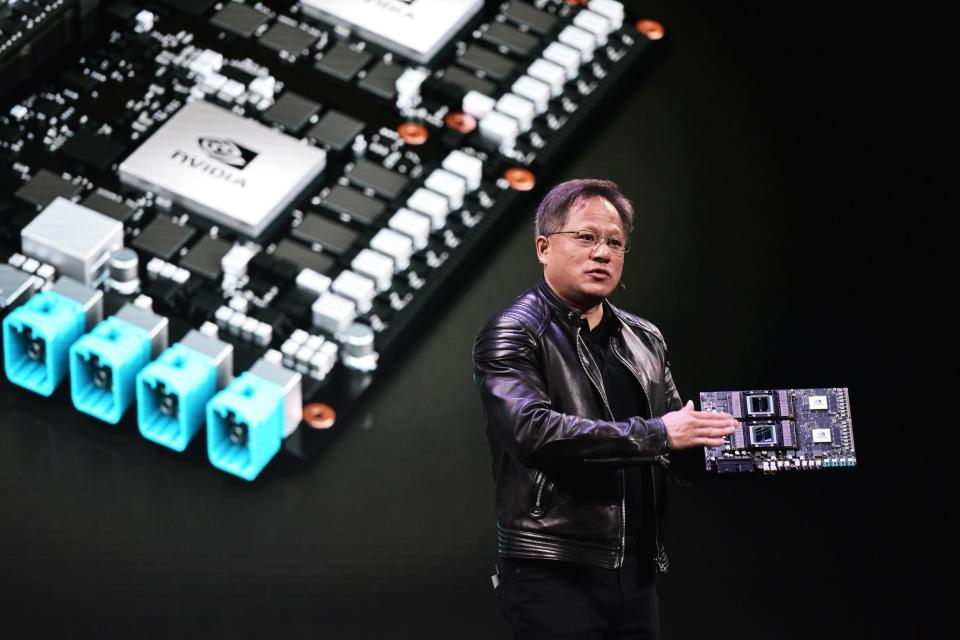

The biggest cheer came from US-listed semiconductor giant Nvidia, which last night revealed a stronger-than-expected start to the year.

FTSE 100 Live Thursday

Germany in recession after 0.3% Q1 decline

Energy regulator Ofgem cuts price cap

Tech sector boosted by Nvidia’s sales surge

Key market data as markets close in London

16:59 , Daniel O'Boyle

Click through the graphs to see the key market data as shares fell and bond yields rose

FTSE closes at 7,570.87

16:40 , Daniel O'Boyle

The FTSE 100 finished the day at 7,570.87, having now lost almost 200 points in the past two days.

Shares fell further after yesterday’s sell-off, bringing the index to its lowest close since March 29, as interest rate expectations rise and the US gets ever-closer to defaulting on its debt.

Alongside shares, gilt prices also fell, causing yields to shoot up close to the levels reached during last year’s catastrophic mini-Budget. The yield on a two-year gilt is now 4.50%

City comment: London offers a ray of hope in our gloomy economy

16:28 , Daniel O'Boyle

IT IS almost exactly a year to the day since the first Elizabeth line services carried fare-paying passengers across London. It has been a long time coming but its impact on the capital’s economy is already huge.

The east-west route has quickly established itself as the busiest railway in Britain and has been a hugely valuable addition to London’s strained transport infrastructure.

Despite the gloom around prospects for the UK economy as a whole there are reasons to be optimistic about London.

Will the Bank of England hike rates by 50bp in one of its next two meetings?

15:54 , Daniel O'Boyle

The City expects that the Bank of England will not only raise rates at each of its next two meetings, but that it will hike them by half a percentage point at one of those meetings.

Markets are pricing in rates above 5% by August, suggesting that they believe a combined rise of 75 basis points across the next two meetings is more likely than not. For that to happen, the Bank would have to raise rates by 50bp in a single go at one of the two meetings.

A rise to 5.5% by November is also almost fully priced in, while markets think that rates will stay at or above 5.25% until at least August of 2024.

Gilt yields rise further

15:48 , Daniel O'Boyle

Gilt yields have risen further, getting even closer to the levels reached after last year’s catastrophic mini-Budget.

At their peak, two-year gilt yields hit 4.7431% in late September of 2022.

Click through the charts to see how the bond market has moved, among other key data.

Boohoo boss takes home £650,000 bonus despite retailer sinking into a loss

15:36 , Daniel O'Boyle

The boss of fast-fashion firm Boohoo has been handed a more than £650,000 bonus despite the company plunging into a loss and seeing its share price lose nearly half its value in a year.

John Lyttle, the chief executive of the retailer, took home a £1.35 million pay packet in the year to February.

Nationwide to increase mortgage rates by up to 0.45%

15:06 , Daniel O'Boyle

Nationwide Building Society has revealed it will increase selected fixed and tracker mortgage rates by up to 0.45% on Friday.

“In the current economic environment swap rates have continued to fluctuate and, more recently, increase, leading to rate rises across the market. This change will ensure our mortgage rates remain sustainable,” a Nationwide spokesperson said.

US GDP revised upwards

14:42 , Daniel O'Boyle

US GDP growth for Q1 has been revised up to 1.3%, from the previous estimate of 1.3%.

Ryan Brandham, head of global capital ,arkets for North America at Validus Risk Management, said the continued strength of the US economy probably won’t stop the Federal Reserve from pausing its interest rate hikes, but it might add to the likelihood of this happening.

“Stronger than expected US jobs and US GDP announcement have demonstrated the resilience of the US Labour market, which will put upwards pressure on wages and inflation.

“We do not except this to prevent the Fed from pausing rate hikes at its next meeting, but this data will support the members favouring a further hike. This balance is reflected in current pricing discounts, which indicate the chance of another hike at one third.”

Nasdaq set to jump after Nvdia earnings

14:24 , Daniel O'Boyle

US stocks are set to rise when market opens, led by the tech sector folllowing Nvdia’s AI-driven profits beat after trading ended yesterday.

Nasdaq futures are up 2.4% to 13970, while S&P 500 futures are up 0.9% to 4161.75. Dow Jones futures, however, are down 0.1% to 32838.00 as fears over the debt limit persist.

Chanel to double the size of London HQ as it commits to capital for 20 more years

14:05 , Daniel O'Boyle

Luxury fashion giant Chanel is set to double the size of its global headquarters in London, after agreeing a new 20-year lease in Mayfair.

The fashion house has signed an agreement to move from the Time and Life building, which has been its home since 2018 when it first moved to London, to 38 Berkeley Square. From 2025, Chanel plans to move its teams to the new building, which will include 86,000 square feet of office space over 11 floors.

Goldman Sachs £170m equal pay settlement could open the door to a wave of UK claims

13:28 , Daniel O'Boyle

Earlier this month, Goldman Sachs agreed to pay a hefty sum in order to settle a US sex discrimination lawsuit. The investment bank had been accused of offering unequal pay and fewer opportunities to female staff.

The settlement is one of the largest to-date, especially regarding issues of equal pay in the US. This case, brought on behalf of approximately 2,800 female Vice Presidents and Associates at Goldman, certainly grabbed headlines across the globe.

Key market data

12:49 , Daniel O'Boyle

Take a look at the key market data as the FTSE 100 picks up slightly from the lows reached this morning, but remains down.

‘Kick in the teeth’ rates set to hurt homeowners and first-time buyers

12:23 , Daniel O'Boyle

First-time buyers and existing homeowners searching for mortgages were warned of a “kick in the teeth today” on fears that fixed rates are certain to rise over the coming weeks following a spike in gilt yields.

The returns on British Government bonds — gilts, which are closely linked to fixed rates offered by banks and building societies — has been rising steadily on fears that the Bank of England will have to keep interest rates “higher for longer” than previously anticipated. Yesterday, when the inflation rate fell only to 8.7%, yields surged again to levels not seen since the aftermath of Kwasi Kwarteng’s ill fated mini-Budget last September.

How James Folger turned gardening leave into online plant business The Stem

11:48 , Lucy Tobin

Gardening leave is common in the City — but James Folger took it very literally when leaving Rothschild.

Instead of starting at his new job, Folger spent his three months gardening leaving deciding to set up his own, er, gardening, business.

He launched The Stem, a “one-stop-shop for all things green”, selling indoor and outdoor plants, dried flowers, grow-your-own sets and pots. Turnover is set to hit £2 million this year.

City Voices: We are right to beware of Chinese economic coercion

10:55

RISHI SUNAK did not mince his words. China, said the Prime Minister, was the “biggest challenge of our age”. The giant power was increasingly “authoritarian” at home while being “assertive” abroad.

It helped that Sunak was speaking at a meeting to which China was not invited. Whether he would be so bold if Chinese representatives were present, is a different matter.

Even so, his words at the weekend’s G7 summit in Hiroshima were about as forthright as it’s possible to be in the guarded language of international diplomacy. He was not alone. Other leaders at the gathering chimed in. Make no mistake, the West regards Beijing as a real and growing danger.

FTSE 100 remains in red, Nvidia-backer Scottish Mortgage up 2%

10:25 , Graeme Evans

Germany’s fall into recession today heaped more pressure on leading shares as the FTSE 100 index eased 28.51 points to 7598.59.

The top flight slumped 1.75% yesterday on worries over the earnings exposure of blue-chip companies in the US.

One area of cheer came from the tech sector after Nvidia, whose chip designs are used in the gaming, mobile and automotive industries, impressed Wall Street with a flying start to 2023 as AI demand soars.

Investment trust Scottish Mortgage, which has 3.2% of its portfolio tied up in the company, rose 11.2p to 656p near the top of the FTSE 100.

Other blue-chip risers included British Gas owner Centrica, which lifted 3.5p to 117.1p as the lower Ofgem price cap signalled the return of competition to the energy market.

The fallers board included clean air technologies business Johnson Matthey, down 61.5p to 1799.5p after its guidance for this year disappointed City analysts.

In the FTSE 250 index, investors backed Tate & Lyle as shares rose 15p to 799.5p after the food ingredients firm sweetened profits by 13% to £253 million.

However, the UK-focused FTSE 250 still weakened 0.5% or 94.93 points to 18,836.23. Fallers included retailer Pets at Home after it reported a 4.8% rise in underlying profits to £136.4 million and forecast a broadly unchanged performance this year.

Shares have been on a strong run lately but lost 11.6p to 355.6p today.

Key data as FTSE falls further

10:14 , Simon Hunt

The FTSE 100 fell again this morning after a decline of 1.8% yesterday amid fears of interest rate rises and the risk of a US debt default.

Meanwhile, gilt yields have shot up to levels not seen since last year’s disastrous mini-budget.

Click through the graphs to see all the key data.

CEO to quit Starling

09:56 , Simon English

ANNE Boden is stepping down as CEO of Starling Bank, which she founded a decade ago.

That news came as Starling revealed revenue for the year to March of £453 million, double what it made a year ago. Profits jumped from £32 million to £195 million.

Boden said: “When I started Starling in 2014, I was told no one ever starts a bank, nobody wins market share and you’ll never make a profit. Today’s results prove them wrong.

“We’ve succeeded in disrupting an entire industry. I’m immensely proud of these results, which are a testament to how far we have come as a team and how fast we’ve moved as a business.”

She will hand over CEO roles to her number two John Mountain, at least on an interim basis.

Her chairman David Sproul said: “She has built Starling from nothing and has led it to become the UK’s leading digital bank in the space of just eight years. It is an astonishing achievement and we all owe her a huge debt of gratitude.”

She is number 43 on the Evening Standard Tech Rich List, with wealth put at £188 million.

AJ Bell says: simplify ISAs

09:34 , Simon English

AJ BELL today called for a simplification of the ISA regime as it unveiled results that show it so far immune to inflation.

The wealth manager saw half year revenues up 37% to £104 million on which it made profits of £42 million. That’s a profit margin of more than 40%, something few other businesses can match.

There is an interim dividend of 3.5p, which is worth £3.1 million to Andy Bell, the founder who stepped back as CEO recently but still holds 22% of the stock.

His successor Michael Summersgill says the move to scrap the pension lifetime allowance – aimed at encouraging doctors not to retire early – has been welcomed by customers.

He said: “We have recently called for similarly bold action from the Government in the ISA market in order to further simplify investing for consumers. At their core ISAs are a simple, tax-efficient savings account but the multiple versions that now exist make it hard for people to know which one is right for them. We believe there only needs to be one ISA that condenses the multiple variants back into a single product.”

Investment platforms like AJ Bell boomed during Covid as customers invested money they couldn’t spend elsewhere. That boom has cooled but the business remains strong despite wider economic pressures.

“We are not blind to inflationary challenges but our business is holding up well,” said Summersgill.

Netflix appearances help revenue double at Round Hill Music

09:28 , Daniel O'Boyle

Revenue almost doubled at music rights investment fund Round Hill Music, thanks to a combination of newly acquired songs and placements in film and television.

The business — which buys the rights to classic songs from artists in order to make use of the royalty rights — made $10.1 million in the first three months of 2023, up from $5.3 million a year earlier.

That was due in part to a 74% increase in revenue from media syncing, with appearances including Louis Armstrong’s ‘What a Wonderful World’ in Netflix documentary Our Universe.

Josh Gruss, CEO of Round Hill Music LP, said: “These results, which are further supported by the beneficial music industry tailwinds that show no sign of dissipating, provide a solid foundation and reason for continued optimism.”

London is back, says pub chain Young's

09:17 , Simon Hunt

Pub chain Young’s today said London has become its strongest-performing region as it welcomed a surge in revenues.

The Wandsworth-based business said the capital had seen just shy of 9% growth in the past seven weeks, while sales in the City were up a whopping 32% on last year.

More than half of its 30 venue investments were in London, Young’s said, while it added to its estate with the acquisition of the Stag pub in Belsize Park.

The firm posted sales of £369 million in the year to the end of March, up 19.4% and increased its dividend from 18.8p to 20.5p.

Young’s boss Simon Dodd said: “London is bouncing back — it really feels back to normal.

“The City is now starting to move into growth too, especially on Tuesdays, Wednesdays and Thursdays, which have become the new Fridays.”

Young’s shares rose 1.7% to 1,185p.

FTSE 100 still under pressure, Johnson Matthey down 3%

08:24 , Graeme Evans

The FTSE 100 index has followed yesterday’s US-driven decline of 1.75% by losing another 0.4% or 30.66 points to 7596.44.

Richard Hunter, head of markets at Interactive Investor, said Germany’s slide into recession and the heavy exposure of the index to the fortunes of the US in terms of overseas earnings meant little appetite for buying.

He added: “The index nonetheless remains in positive territory this year and is ahead by 2%, although the scale of potential and imminent challenges are certainly not being underestimated.”

In terms of the reaction to today’s corporate updates, Tate & Lyle shares rose 2% or 15.5p to 800p after its annual results but clean air firm Johnson Matthey fell 3% or 63p to 1798p on the back of its full-year numbers.

The FTSE 250 index weakened 24.07 points to 18,907.09, with Pets at Home shares down 1.6p at 365.6p and Qinetiq up 5p to 375p following their annual results.

Office firm Workspace sees rental income jump but property portfolio value lower

08:10 , Joanna Bourke

Many SMEs are thriving and expanding not just in central London, but also areas such as Deptford, Hoxton and Wood Green, the chief executive of flexible offices company Workspace Group said today.

Workspace boss Graham Clemett said the landlord has observed high demand for space at not only City and West End buildings, but also boroughs beyond zone one. He said interest for new and bigger offices is coming from a large range of sectors, including tech, fashion, architecture and more.

In the year to March 31 Workspace saw net rental income jump 34% to £116.6 million.

But the group fell into the red with a £37.5 million pre-tax loss compared with a £124 million profit. That was largely due to the value of the estate falling 3.2% on an underlying basis to £2.7 billion. Stripping out the valuation change, trading profit after interest was 29% higher.

Read more HERE.

Qinetiq upgrades revenues target, profits rise

08:02 , Graeme Evans

Qinetiq, the defence-focused science and engineering company, today set its sights on delivering annual revenues of £3 billion by 2027.

The figure compares with the FTSE 250 firm’s previous guidance of £2.3 billion and the £1.6 billion delivered in today’s annual results. Operating profits for the year to 31 March rose to £178.9 million, up from £137.4 million the year before.

Highlights over the past year included a contract with the US Army worth £92 million to deliver digital night vision technology and the renewal of the 10-year £260 million agreement covering experimentation, test and evaluation services for the Royal Navy’s fleet.

Chief executive Steve Wadey said Qinetiq entered the new financial year with optimism as the company continues to play a critical role serving the national security interests of its customers.

He added: “We are operating in an uncertain world and the heightened threat environment is increasing demand for our distinctive offerings, which are closely aligned to our customers’ priorities.

“We are now seeing an increased addressable market presenting opportunities for further growth and enhanced shareholder returns.”

United Utilities investors set for £310 million payday as dividend hiked despite fall in profit

07:39 , Michael Hunter

United Utilities is paying out £310 million to investors via a higher dividend, even as profits slumped at the water company that covers much of England’s north west.

It also conceded that “a step change is needed” over sewage overflows into rivers, saying:

“Communities are concerned about the country’s rivers and particularly the impact of storm overflows. We have listened, understand the strength of feeling and we agree that we need to go further and faster to reduce the number of storm overflow activations.”

The company said the step change “will take significant time and sustained, new investment” and said that it had cut the number of overflows by 39%, and said it would be monitoring all of its storm outflow points by the end of the year.”

It said investment would reach £200 million in the final two years of its current financial planning period.

For the financial year to the end of March, profit before tax was down 42% to £256 million from revenue of £1.8 billion, down 2%. It lifted its final dividend by 4.6% to 30.34p per share.

Germany in recession after revised GDP reading

07:33 , Graeme Evans

Europe’s largest economy is in recession after figures this morning showed a second consecutive quarter of decline in Germany’s GDP.

The revised estimate for a 0.3% contraction in the first quarter followed a decline of 0.5% in the previous three months, with two consecutive falls representing recession. The updated figure compared with an original estimate for no change in activity.

A 1.2% fall in household consumption contributed to the negative first quarter performance, although separate figures from GfK today showed a better-than-expected consumer confidence reading of minus 24.2.

Sugar rush at Tate & Lyle as sales surge 27% but growth will slow to 4-6% next year

07:23 , Simon Hunt

Tate & Lyle posted a sweet 27% surge in revenues in the year to March to £1.8 billion and saw profits top £253 million as it benefitted from a surge in the price of sugar over the past year.

However, the firm said it expects more modest growth of 4-6% in the year ahead.

The company said it plans to increase in final dividend of 2.5% to 13.1p per share for full-year dividend of 18.5p per share.

CEO NIck Hampton said: “The growth opportunity ahead is substantial and we saw encouraging progress in the year with revenue from new products and solutions wins both demonstrating good momentum.”

Cineworld set to exit bankruptcy protection in July

07:23 , Daniel O'Boyle

Struggling cinema chain Cineworld now expects to emerge from Chapter 11 bankruptcy protection in July, after it agreed a deal to be seized by creditors in April.

Under the deal, all shareholders would be wiped out, but Cineworld would cut its debts by $4.53 billion, allowing it to stay alive.With this deal now being approved by a bankruptcy court and creditors holding 69% of Cineworld’s debt, the business said it now is set to exit bankruptcy protection in the next two months.

Cineworld, which also owns Pictureworld Cinemas, will continue to operate as usual during the restructuring period.

US debt rating on negative watch, FTSE 100 seen flat

07:15 , Graeme Evans

Wall Street markets closed about 0.7% lower last night as worries over whether US policymakers will reach an agreement in time to avoid a debt default increased.

Fitch Ratings turned up the pressure last night when it placed the country’s AAA rating on negative watch due to the heightened risk the government will miss payments.

US futures markets are pointing towards a steadier session this afternoon, with the Nasdaq set to be the star performer after semiconductor giant Nvidia beat earnings and revenues targets and issued strong guidance for the current quarter.

A combination of US debt ceiling fears and the prospect of even higher interest rates meant the FTSE 100 index yesterday finished 1.75% lower during the worst session for European markets since March.

There’s unlikely to be much change in the mood today as CMC Markets expects the FTSE 100 index to open three points lower at 7624.

Households to be more than £400 a year better off as Ofgem energy cap slashed

07:12 , Daniel O'Boyle

Households will be more than £400 a year better off on average from July after the cap on energy bills was slashed following steep falls in wholesale gas and electricity prices.

Energy regulator Ofgem on Thursday set the cap at £2,074, down from £3,280 from April to July. That is well below the £2,500 energy price guarantee put in place by Liz Truss when she was Prime Minister last September when the energy crisis sparked by Russia’s invasion of Ukraine sent market prices spiralling to record levels.

Nvidia shares soar on chip demand for AI boom

06:53 , Simon Hunt

Shares in semiconductor giant Nvidia soared in after-market trading overnight aftet the the world’s most valuable listed chipmaker said it was increasing supply to meet a surge in demand for artificial intelligence chips.

The firm forecast current-quarter revenue of $11 billion, well ahead of expectations. Analysts polled by Refinitiv had forecast revenue of $7.15 billion.

Shares rose 28%.

“In January, the new demand was incredibly steep,” CEO Jensen Huang told Reuters. “We had to place additional orders, and we procured substantially more supply for the second half” of 2023.

Recap: Yesterday’s top stories

06:45 , Simon Hunt

Good morning. Here’s a summary of our top stories from yesterday.

Inflation dropped below 10% for the first time in months, but food inflation continued to be stubbornly high.

The FTSE 100 hit a two-month low amid fears over the US debt ceiling.

Shares in M&S jumped after the retailer said it planned to bring back dividend payments.

There are growing fears homeowners will be hit by two interest rate hikes this summer.