Google’s AI Narrative is Starting to Flip

Hours after Google wrapped its major cloud keynote on Tuesday, I sat down for dinner with three public tech company CEOs and a handful of journalists on New York’s West Side. It was the type of gathering happening more frequently in the post-COVID era, where top executives and media meet to discuss the latest AI breakthroughs. And unlike most such gatherings, it was on the record.

Within the first 20 minutes, the future of Google came up, and the feeling in the room was surprisingly positive. Box CEO Aaron Levie, Datadog CEO Olivier Pomel, and MongoDB CEO Dev Ittycheria took turns explaining why the company is in better position than the public perceives. And while Google’s challenges in AI remain real, it was perhaps a signal that the dark narrative around the company is starting to lift.

Let me take you inside the room.

“In two or three years from now, we’ll look back and be confused about how Google is written off in these skirmishes,” Box CEO Aaron Levie, the evening’s host, told the room.

We’d been discussing Google’s failure to lock down Anthropic — an OpenAI rival that Google invested $300 million in before Amazon put in billions more — but Levie made the case that Google didn’t need to lock down Anthropic like Microsoft did OpenAI. Google has enough technical infrastructure and resources, Levie said, that it will inevitably figure out a winning AI move, and it’s already showing signs. This was the evening’s theme.

“If you just say, ‘Okay, who has essentially the world’s largest dataset, who has an arbitrarily large number of the right engineers for the problem, and unlimited capital. Those are the core ingredients,” said Levie. “There’s effectively very few secrets in AI in terms of how these training runs and algorithms work at some dimensional point, like within a six or 12-month period. So I would not count out Gemini.”

Google, per Levie, has all the core ingredients necessary to build the leading frontier model. It has the data, money, and computing power. So even if OpenAI’s GPT-4 and Anthropic’s Claude lead today, it’s almost guaranteed Google’s Gemini will match or surpass them, at least in Levie’s view.

Google also has custom-built accelerator chips meant for AI workloads, the latest of which it announced this week, another underrated advantage as competitors scramble for silicon, said DataDog’s Pomel. “They’re also the least constrained on GPUs as they’ve been making their own for a while,” he said. “So they don’t have to beg for NVIDIA GPUs.”

At this week’s Google Cloud Next conference in Las Vegas, in fact, Google spent so much time talking about its infrastructure advantage in the AI discipline that it led to an endorsement from Stratechery’s Ben Thompson, who’d called for Google CEO Sundar Pichai’s job a few weeks ago. “What hasn’t changed — because it is the company’s nature, and thus cannot — is the reliance on scale and an overwhelming infrastructure advantage,” Thompson wrote. “That, more than anything, is what defines Google, and it was encouraging to see that so explicitly put forward as an advantage.”

At this point in the dinner, it was hard to ignore Google’s persisting challenges. Its margins stand to decline due to expensive AI search and R&D costs. And even if Gemini performs best, Google’s long history of struggling to sell its cloud services (at least until recently) could make any AI model superiority somewhat less meaningful. I shared these concerns with the table, and it led to four full seconds of silence. That was telling. Google will not have an easy transition.

But then MongoDB’s Ittycheria jumped in to offer some nuance.

“I don’t know if I’d agree that their sales and services are weak,” he said. “They have a much smaller set of services that they offer, and consequently, I think customers — a lot — view them as their second cloud.”

That said, Ittycheria added, if Google comes out with an AI model that is materially better than its competitors, it could shift the reality for its cloud business.

“It’s still very much a race,” said Datadog’s Pomel.

Google may be seeing the benefits from AI already. Google Cloud was profitable for the first time on record in 2023. And as it soundly beat expectations in the fourth quarter it said AI was a factor.

“We’ve seen very few situations where a company was under existential threat, that had the resources to get through it, and not get through it in tech,” said Levie. “The modern tech playbook has sort of figured out what you do in these situations….. Google has seen how it destroyed previous monopolies essentially. I do not think they’re gonna let that happen.”

For Google, the biggest concern remains whether it can break out of its cautious, big company culture and keep pace with its rivals’ shipping cadence. This was the biggest issue in its Gemini image generation blow up, and what the generative AI race has exposed. But Levie noted that even Microsoft figured cloud out eventually, even if it took a transformative leader in Satya Nadella to get it out of its cultural malaise.

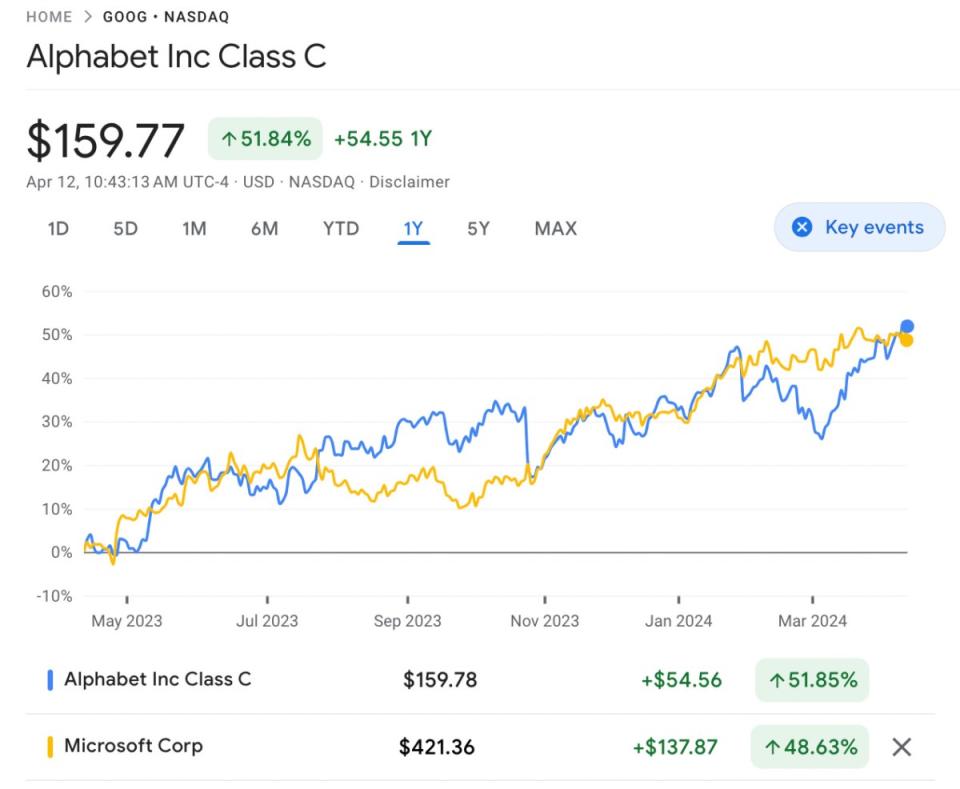

This week though, Google hit an all time high in the stock market, its search dominance remains intact, and, as CNBC host Scott Wapner noted in my discussion with him on set, its stock has tracked with Microsoft over the past year, both up around 50%.

The dark cloud around Google’s AI efforts have been there for a reason, but if the vibe at the dinner was any indication, they’re starting to lift, even if slightly.

The post Google’s AI Narrative is Starting to Flip appeared first on TheWrap.