Stocks are just as expensive now as they were before the crash: Morning Brief

Thursday, April 9, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Earnings estimates are finally catching up to stock prices

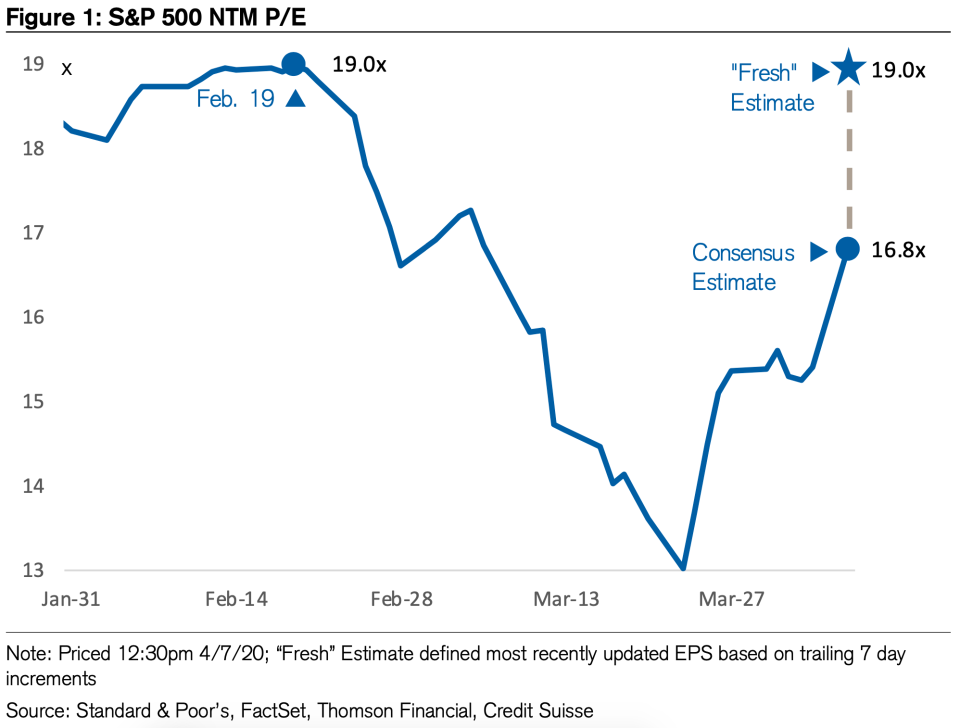

Early on in the market selloff, some market pundits were quick to say stocks were getting cheap as reflected by a forward P/E multiple that plunged from a high of 19x to 13x, which is considerably lower than the 10-year average of 15x.

At the time, Yahoo Finance Morning Brief readers were warned that this was largely due to the lag in analysts revising their earnings expectations lower to reflect the new reality of the economic lockdowns triggered by the coronavirus pandemic.

A month later, analysts are still slow to revise their earnings lower (some have even suspended their forecasts). But they’re coming down, and they’re coming down sharply.

In fact, if you only consider the estimates offered by analysts who’ve made revisions in the past week, you’ll find that earnings estimates are now so low that they’ve paced with the decline in stock prices. And if you know how arithmetic works, you know that means the forward P/E is now up.

Credit Suisse’s Jonathan Golub observed that with the recent modest rebound in stock prices, that forward P/E is now back at around 19x.

“This is the same level it held on Feb 19, the all-time high for stock prices,” Golub wrote on Tuesday.

Though, you could also say that we will have a V-shaped recovery in earnings whenever the economy comes back online, in which case you could once again argue prices are indeed cheap.

But then again, perhaps the market is also telling us that it doesn’t buy the idea that things will come back online that soon.

In some ways, this whole conversation was futile from the start as Morning Brief readers know that forward P/Es, whether high or low, aren’t very reliable predictors of the stock market anyway.

Investing’s tough. Especially when you consider that the experts who get paid more than most of us to provide a better answer have almost never been more far apart in what they expect.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

8:30 a.m. ET: PPI Final Demand month-on-month, March (-0.4% expected, -0.6% in February); PPI excluding food & energy month-on-month, March (0.0% expected, -0.3% in February); PPI Final Demand year-on-year, March (0.5% expected, 1.3% in February); PPI excluding food & energy year-on-year, March (1.2% expected, 1.4% in February)

8:30 a.m. ET: Initial Jobless Claims, week ended April 4 (5 million expected, 6.648 million prior); Continuing Claims, week ended March 28 (3.029 million prior)

9:45 a.m. ET: Bloomberg Consumer Comfort, week ended April 5 (56.3 prior)

10 a.m. ET: Wholesale Inventories month-on-month, February final (-0.5% expected, -0.5% prior)

10 a.m. ET: University of Michigan Sentiment, April preliminary (75.0 expected, 89.1 prior)

Take our survey

How's the coronavirus recession affecting you? And what questions can we answer?

Top News

UK economy shrank before full force of coronavirus crisis hit [Yahoo Finance UK]

Warren Buffett’s Berkshire Hathaway joins global debt splurge [Bloomberg]

Starbucks sees 47% drop in second-quarter earnings on coronavirus hit [Reuters]

Streaming service Disney+ crosses 50 million paid subscribers globally [Reuters]

YAHOO FINANCE HIGHLIGHTS

Volcker recession-like coronavirus impact could set up 'multi-million' job gains: Goldman

Why Costco is the ultimate coronavirus pandemic stock to own

Chick-fil-A, Starbucks top list of favorite food brands among teens: Survey

—

Editor’s note: Morning Brief will be observing Good Friday on April 10. It will return on Monday, April 13.

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay