UK interest rates: Bank of England announces interest rate decision after fall in inflation

Interest rates have been frozen by the Bank of England for the seventh consecutive month despite another drop in inflation.

Bank chiefs on Thursday held the rate at 5.25 per cent in another blow to workers, homeowners and borrowers.

It comes after official figures published on Wednesday showed that rising prices had fallen back to 2 per cent - the Bank’s target - for the first time in nearly three years, down from 2.3 per cent in May.

The latest inflation figures mean that prices are still rising across the country, but at a much slower rate than in recent years when households and businesses were being squeezed during the peak of the cost crisis.

After the fall in inflation, the Confederation of British Industry (CBI) said the stage was now set for the bank to cautiously cut interest rates in August.

CBI principal economist Martin Sartorius said on Wednesday: “Today’s data sets the stage for the Monetary Policy Committee to cut interest rates in August, in line with our latest forecast’s expectations.”

Key points

Bank freezes rates at 5.25%

Fresh blow for homeowners, borrowers and workers

Governor says he needs to be ‘sure’ inflation will stay low

Bank of England expected to hold interest rates at current level

Wednesday 19 June 2024 22:40 , Alexander Butler

The Bank of England (BoE) is set to hold interest rates at the current level despite inflation falling back to the 2 per cent target for the first time in nearly three years.

The UK’s central bank is expected to freeze interest rates at 5.25 per cent on Thursday after steadily increasing rates since 2021 in an effort to bring down inflation.

It comes after the Office for National Statistics revealed the Consumer Prices Index (CPI) dropped to 2 per cent in May, down from 2.3 per cent in April.

What have economists said?

Thursday 20 June 2024 00:01 , Alexander Butler

Experts have cautioned that a rate cut this summer could be less likely until the majority of the Bank’s Monetary Policy Committee (MPC) feel certain that inflation is under control.

Crucially, the rate of services inflation, which looks only at service-related categories like hospitality and culture, and is a key gauge for policymakers, has remained more stubborn than expected.

James Smith, developed economist for ING bank said: “Indeed at 5.7 per cent, services inflation is now 0.4 percentage points above the Bank’s forecast from the May Monetary Policy Report.

“That all but confirms the Bank of England will keep rates on hold on Thursday. We’re therefore sticking to our call for the first rate cut to come in August, with a total of three cuts this year.”

Laura Suter, director of personal finance at AJ Bell, added: “It’s highly likely the Bank will want to wait to see the outcome of the election and the final economic plans before making that first cut.

“With no meeting in July, that means all eyes are now firmly on the August MPC meeting for our first potential cut to rates.”

Inflation drops to Bank of England’s 2% target for first time in almost three years

Thursday 20 June 2024 01:00 , Alexander Butler

Inflation has fallen back to the 2 per cent target for the first time in nearly three years in a boost for prime minister Rishi Sunak’s faltering election campaign.

The Office for National Statistics figures show the Consumer Prices Index (CPI) dropped to 2 per cent in May, down from 2.3 per cent in April.

The new figure marks the first time inflation has been at the Bank of England’s target since July 2021, before the cost-of-living crisis saw inflation shoot up – at one stage hitting levels not seen for 40 years.

Inflation drops to Bank of England’s 2% target for first time in almost three years

How could the new inflation rate affect food prices and bills?

Thursday 20 June 2024 02:00 , Alexander Butler

How could the new inflation rate affect food prices and bills?

UK borrowing costs set to stay the same despite inflation hitting 2% target

Thursday 20 June 2024 03:00 , Alexander Butler

Borrowers hoping for some relief from higher costs are likely to be disappointed by expectations that UK interest rates will not be cut on Thursday, despite inflation returning to target.

Most economists are expecting policymakers to hold UK interest rates at 5.25 per cent when the central bank announces its latest decision.

The announcement will come a day after official figures showed that inflation returned to the 2% target last month, for the first time since July 2021.

UK borrowing costs set to stay the same despite inflation hitting 2% target

What are interest rates?

Thursday 20 June 2024 05:00 , Alexander Butler

An interest rate tells you how high the cost of borrowing is, or high the rewards are for saving. If you’re a borrower, the interest rate is the amount you are charged for borrowing money.

This is shown as a percentage of the total amount of the loan. The higher the percentage, the more you have to pay back, for a loan of a given size.

If you’re a saver, the savings rate tells you how much money will be paid into your account, as a percentage of your savings. The higher the savings rate, the more will be paid into your account for a given sized deposit.

How does inflation affect interest and mortgage rates?

Thursday 20 June 2024 06:00 , Alexander Butler

How does inflation affect interest and mortgage rates?

Research finds horrifying cost of a pint in 2040 if inflation stays at recent levels

Thursday 20 June 2024 07:00 , Alexander Butler

Drinkers may need to spend a small fortune on a trip to the pub by 2040, according to new research analyising the potential cost of a pint in the future.

Soaring inflation has seen the average cost of a lager go up by 11 per cent over the past 12 months.

If that rate were to be maintained for the next 16 years then a pint would cost an eye-watering £24.91 by 2040 - nearly enough to buy 36 cans of 440ml Carlsberg from Tesco.

Research finds horrifying cost of a pint in 2040 if inflation stays at recent levels

Rates decision at lunchtime

Thursday 20 June 2024 07:33 , Matt Mathers

Good morning and welcome to the Independent’s coverage of interest rates.

The Bank of England is set to announce later whether or not it will cut rates after inflation fell back to 2 per cent on Wednesday.

Analysts expect rates to be held at 5.25 per cent despite the drop in rising prices.

A decision is expected around lunchtime - stay tuned for the latest updates.

Recap: Inflation returns to 2% target for first time in nearly three years

Thursday 20 June 2024 07:52 , Matt Mathers

Inflation has returned to the 2% target for the first time in almost three years in what comes at a critical time, just weeks before the nation heads to the polls.

The Office for National Statistics (ONS) said Consumer Prices Index (CPI) inflation fell to 2% in May, down from 2.3% in April.

Full report:

Inflation returns to 2% target for first time in nearly three years

How does inflation affect interest and mortgage rates?

Thursday 20 June 2024 08:27 , Matt Mathers

UK inflation slowed to 2 per cent in May, dropping to its lowest level since July 2021, according to new official figures.

It has matched the target rate of inflation set by the Government and Bank of England after a slowdown in price rises over the past two years.

Full report:

How does inflation affect interest and mortgage rates?

UK borrowing costs set to stay the same despite inflation hitting 2% target

Thursday 20 June 2024 10:08 , Matt Mathers

Borrowers hoping for some relief from higher costs are likely to be disappointed by expectations that UK interest rates will not be cut on Thursday, despite inflation returning to target.

Most economists are expecting policymakers to hold UK interest rates at 5.25 per cent when the central bank announces its latest decision.

Full report:

UK borrowing costs set to stay the same despite inflation hitting 2% target

Breaking: No fall in interest rates despite inflation hitting 2% target, Bank of England announces

Thursday 20 June 2024 12:03 , Matt Mathers

The Bank of England has declined to cut interest rates from their 16-year high – despite inflation finally falling to meet its target of 2 per cent.

Homeowners struggling with soaring mortgages will be forced to wait at least another two months for borrowing costs to fall, after the Bank’s nine-member Monetary Policy Committee opted on Thursday to hold the base rate at 5.25 per cent for the seventh consecutive month.

More to follow on this breaking news story:

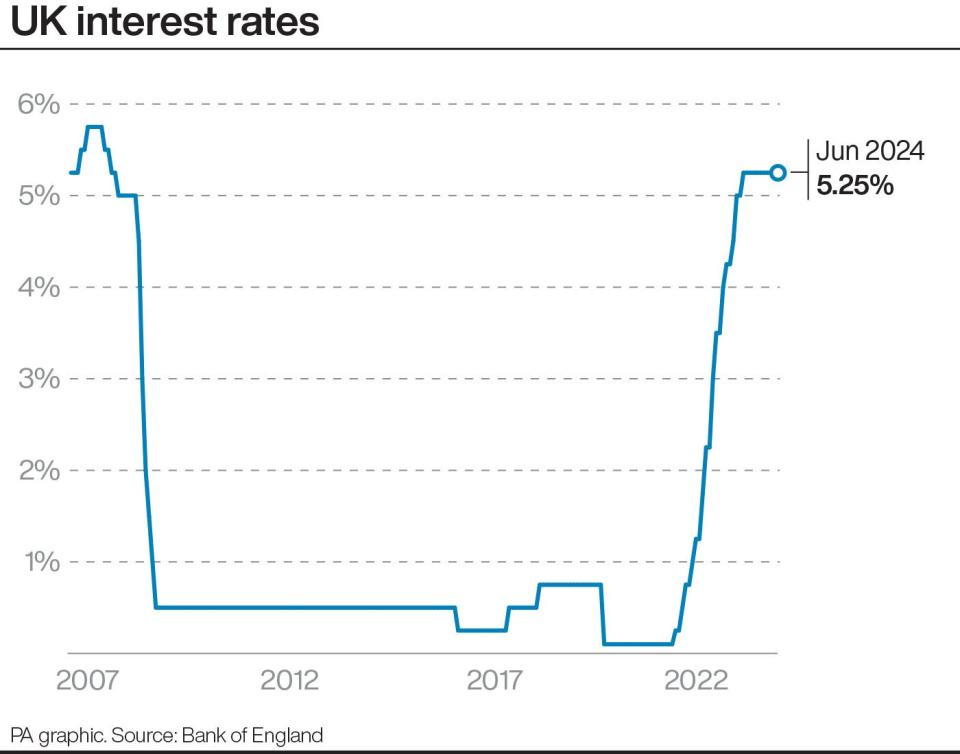

Graph shows interest levels since 2007

Thursday 20 June 2024 12:06 , Matt Mathers

Bank failing to act in interest of workers - union

Thursday 20 June 2024 12:09 , Matt Mathers

The Bank of England has “failed to act in the interest of workers” by deciding against a cut to interest rates, a union has said.

Sharon Graham, Unite general secretary, said: “Once again, the Bank of England has failed to act in the interest of workers and hard-pressed families.

“Major economies across the world have cut interest rates and the UK must follow suit. High interest rates boost the profits of city bankers but hit all of us paying mortgages and rents in the pocket. It’s time for the bank to get a grip.”

7-2 majority vote for rate freeze

Thursday 20 June 2024 12:11 , Matt Mathers

The central bank’s monetary policy committee voted by a majority of seven to two to keep rates unchanged.

Members Dave Ramsden and Swati Dhingra voted to cut rates by 0.25 percentage points.

IPPR: Interest rates too high for too long

Thursday 20 June 2024 12:13 , Matt Mathers

Interest rates have been too high for too long, an economic think tank has said.

Dr George Dibb, associate director for economic policy at IPPR, said: “The Bank of England has tightened the screws too much for too long, holding back the UK’s economic recovery. It should have followed the European Central Bank by starting to cut rates today.

“The Bank has to balance lingering price rises, notably in services, with the UK’s zero economic growth and a cooling labour market. With inflation expectations back down to pre-pandemic levels, it’s time for the Bank to switch gears, support the economy more, and cut rates.”

We need to be sure inflation stays low, Bank governor says

Thursday 20 June 2024 12:21 , Matt Mathers

Officials “need to be sure” inflation will stay low before cutting interest rates, the Bank’s governor Andrew Bailey has said.

The decision comes a day after official figures showed the rate of inflation hit the Bank’s 2 per cent target in May for the first time in nearly three years, prompting the prime minister to declare “we’ve got there” after the milestone was reached.

However, some policymakers on the Bank’s nine-person Monetary Policy Committee (MPC) felt that “more evidence of diminishing inflation persistence was needed” before they could safely cut rates.

In particular, they felt that services inflation – which looks only at service-related prices such as hospitality and culture – had remained stubborn, and wage growth was rising faster than forecast.

How does inflation affect interest and mortgage rates?

Thursday 20 June 2024 12:50 , Matt Mathers

UK inflation slowed to 2 per cent in May, dropping to its lowest level since July 2021, according to new official figures.

It has matched the target rate of inflation set by the Government and Bank of England after a slowdown in price rises over the past two years.

Full report:

How does inflation affect interest and mortgage rates?

ICYMI: Bank of England set to hold rates to avoid ‘rocking the boat’ pre-election

Thursday 20 June 2024 13:20 , Matt Mathers

Hopes that the Bank of England could start cutting interest rates this month could be dashed as experts expect policymakers not to “rock the boat” in the run-up to the General Election.

The central bank is due to announce its latest decision on interest rates on Thursday.

Full report:

Bank of England set to hold rates to avoid ‘rocking the boat’ pre-election

Pound edges lower against US dollar after rates deecision

Thursday 20 June 2024 14:06 , Matt Mathers

The pound edged lower against the US dollar and the euro following the Bank of England’s rate decision.

Sterling slipped 0.2 per cent to 1.269 US dollars and was 0.1 per cent lower at 1.183 euros.

Rate freeze ‘disappointing’ - small businesses

Thursday 20 June 2024 15:03 , Matt Mathers

In response to the latest Bank of England interest rate decision, Federation of Small Businesses (FSB) national chair Martin McTague said: “Yet again, the MPC has opted to stick instead of twist, a move which was widely predicted but which is no less disappointing for it.

“The high plateau rates are currently stuck at is now undermining growth as small firms struggle to access affordable finance to help them expand.

“Inflation is now back on target and holding off a cut in the base rate until a future date risks snuffing out tentative signs of a recovery in GDP, with the flat growth in April a warning sign.”

Interest rate freeze ‘no suprise’ - Quilter Investors

Thursday 20 June 2024 15:19 , Matt Mathers

Lindsay James, investment strategist at Quilter Investors, said: “Though inflation hitting 2% marked a significant milestone, it is simply not enough to allow the Bank of England to declare job done.

“Instead, the monetary policy committee has opted to leave interest rates unchanged once more.

“While it will come as a bitter blow to the Conservative Party, this decision is no real surprise given month-on-month figures suggest inflation is unlikely to remain at 2% for long.

“It is instead expected to rise again later this year and ultimately settle between 2% and 3%.

“The Bank will be keeping a keen eye on wage growth, which remains around 6%, as well as services inflation, which has been taking its time in coming down and has continued to feed into elevated core inflation.”

ICYMI: How does inflation affect interest and mortgage rates?

Thursday 20 June 2024 16:05 , Matt Mathers

UK inflation slowed to 2 per cent in May, dropping to its lowest level since July 2021, according to new official figures.

It has matched the target rate of inflation set by the Government and Bank of England after a slowdown in price rises over the past two years.

Full report:

How does inflation affect interest and mortgage rates?

Borrowers are crying out for help, but interest rate cuts might not come until November

Thursday 20 June 2024 17:00 , Matt Mathers

Struggling homeowners are desperate for a long-anticipated cut in the cost of borrowing.

But with a change of government looking likely, the Bank of England might be tempted to wait as long as late autumn, says James Moore.

Read James’s piece in full here:

Interest rates are held again – and cuts might not come until November

ICYMI: No fall in interest rates despite inflation hitting 2% target, Bank of England announces

Thursday 20 June 2024 18:00 , Matt Mathers

The Bank of England has declined to cut interest rates from their 16-year high – despite inflation finally falling to meet its target of 2 per cent.

Homeowners struggling with soaring mortgages will be forced to wait at least another two months for borrowing costs to fall, after the Bank’s nine-member Monetary Policy Committee opted on Thursday to hold the base rate at 5.25 per cent for the seventh consecutive month.

Full report:

No fall in interest rates despite inflation hitting 2% target